DEF 14A: Definitive proxy statements

Published on April 17, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee paid previously with preliminary materials

[ ] Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Letter from the Chairperson

April 17, 2025

Dear Stockholder:

On behalf of the Board of Directors, I am pleased to invite you to the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Ingram Micro Holding Corporation. The meeting will be held virtually on Wednesday, June 4, 2025, at 11:30 am (Pacific), at www.virtualshareholdermeeting.com/INGM2025.

On or about April 17, 2025, we sent a Notice of Internet Availability of Proxy Materials (“Notice”) to stockholders. The Notice for the Annual Meeting contains details on how to access and review the materials, retrieve your proxy card, and submit your vote online. To request a printed copy of the proxy materials, please follow the instructions outlined in the Notice.

We encourage you to vote regardless of whether you plan to attend the Annual Meeting. You may cast your vote at the meeting, online using the instructions provided in the Notice or proxy card, by telephone, or by mailing your completed proxy card in the postage-prepaid return envelope if you received paper materials.

We are grateful for your ongoing commitment to Ingram Micro.

Sincerely,

Alain Monié

Chairperson of the Board of Directors

Notice of 2025 Annual Meeting of Stockholders

April 17, 2025

Irvine, CA

To our Stockholders:

Ingram Micro Holding Corporation (“Ingram Micro” or the “Company”) is holding its 2025 Annual Meeting of Stockholders (the “Annual Meeting”) virtually on Wednesday, June 4, 2025, at 11:30 am (Pacific), at www.virtualshareholdermeeting.com/INGM2025.

At the Annual Meeting, you will be asked to:

| 1. | Elect four directors to a three-year term (see page 2, “Proposal 1”); |

| 2. | Approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers (see page 18, “Proposal 2”); |

| 3. | Approve, on a non-binding advisory basis, the frequency of holding future advisory votes on the compensation of named executive officers (see page 19, “Proposal 3”); and |

| 4. | Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 27, 2025 (see page 49, “Proposal 4”, together with Proposal 1, Proposal 2, and Proposal 3, each a “Proposal” and collectively, the “Proposals”). |

Our Board of Directors unanimously recommends that you vote “FOR” the nominees under Proposal 1, “FOR” Proposals 2 and 4, and “ONE YEAR” for Proposal 3.

Stockholders of record as of the close of business on April 10, 2025, have the right to receive notice of and vote at the Annual Meeting, including any adjournments or postponements thereof. For ten (10) days prior to the Annual Meeting, a complete list of registered stockholders will be available for examination at our office at 3351 Michelson Drive, Suite 100, Irvine, CA 92612.

Your vote at the Annual Meeting is important. To ensure your participation at the Annual Meeting, we encourage you to submit your proxy as soon as possible by internet, phone, or mail, as described in greater detail on your proxy card or voter instruction form.

The proxy materials, including Ingram Micro’s 2024 Annual Report, are available at https://ir.ingrammicro.com/.

By Order of the Board of Directors,

Augusto Aragone

Executive Vice President, Secretary and General Counsel

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting To Be Held on June 4, 2025: This Proxy Statement and our 2024 Annual Report are available at www.proxyvote.com. |

Table of Contents

1 |

|

1 |

|

2 |

|

Biographies of Nominees for Election to New Three-Year Terms that will Expire in 2028 |

3 |

Biographies of Continuing Directors Not Being Considered for Election at this Annual Meeting |

5 |

9 |

|

9 |

|

9 |

|

10 |

|

10 |

|

11 |

|

12 |

|

14 |

|

14 |

|

15 |

|

15 |

|

16 |

|

17 |

|

18 |

|

Proposal 3: Frequency of the Advisory Vote on Executive Compensation |

19 |

20 |

|

20 |

|

32 |

|

33 |

|

47 |

|

Proposal 4: Ratification of Independent Registered Public Accounting Firm for Fiscal Year 2025 |

49 |

50 |

|

50 |

|

51 |

|

52 |

|

52 |

|

52 |

|

55 |

|

Security Ownership of Certain Beneficial Owners and Management |

55 |

56 |

|

57 |

|

57 |

|

61 |

Proxy Statement

Introduction and Summary

In July 2021, Platinum Equity, LLC together with its affiliated investment vehicles (“Platinum”) acquired Ingram Micro Inc., a Delaware corporation and operating company, which had previously been a publicly traded company from 1996 until 2016. Through the acquisition, Ingram Micro Inc. became an indirect subsidiary of the Company (Ingram Micro Holding Corporation), which remained privately held until October 2024 when the Company completed an initial public offering (“IPO”). Platinum currently retains ownership and control of approximately 90% of the voting power of the Company’s outstanding common stock, par value $0.01 (“Common Stock”).

Because Platinum continues to hold more than a majority of the voting power of the Company’s outstanding Common Stock entitled to vote generally in the election of directors, including at the Annual Meeting, we are a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange (“NYSE”). In accordance with applicable NYSE exemptions, the Company has elected not to comply with certain corporate governance requirements. For example, we do not have a majority of independent directors—a majority of our directors are affiliated with Platinum Equity Advisors, LLC (“Platinum Advisors”).

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of Ingram Micro for use at the Annual Meeting, which will be the first annual meeting held following the IPO. By returning a completed proxy card, or voting by internet or phone, you are giving instructions on how your shares are to be voted at the Annual Meeting.

This summary provides a high-level review of the information contained within this Proxy Statement. This summary does not contain all of the information you should consider, and we highly recommend that you read the Proxy Statement in full before you vote.

All references herein to “Fiscal Year 2025,” “Fiscal Year 2024,” and “Fiscal Year 2023” represent the fiscal years ended December 27, 2025, December 28, 2024, and December 30, 2023, respectively.

Annual Meeting

Date and Time |

Wednesday, June 4, 2025, at 11:30 am (Pacific) |

Location |

Virtually at www.virtualshareholdermeeting.com/INGM2025 |

Who Can Vote |

Stockholders of record as of April 10, 2025, are entitled to vote. |

Proposals

No. |

Proposal |

Board Recommendation |

1 |

Elect four directors to a three-year term. |

FOR each |

2 |

Approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers. |

FOR |

3 |

Approve, on a non-binding advisory basis, the frequency of holding future advisory votes on the compensation of named executive officers. |

ONE YEAR |

4 |

Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for Fiscal Year 2025. |

FOR |

1

Proposal 1: Election of Directors

The Board is the Company’s governing body with responsibility for general oversight and approval of corporate matters and significant transactions.

Our Board currently consists of thirteen members. According to our Second Amended and Restated

Certificate of Incorporation (“Certificate of Incorporation”), our Board is divided into three classes of directors, each serving staggered three-year terms. One class of directors is elected at each annual meeting to serve from the time of their election until the third annual meeting following their election.

There are four directors in Class I, Craig Ashmore, Christian Cook, Leslie Heisz, and Alain Monié, whose term of office expires at the 2025 Annual Meeting and whom the Board has nominated for reelection. If reelected, the nominees will serve until the 2028 Annual Meeting or until their respective successors have been duly elected and qualified.

Each nominee has agreed to serve as director, if reelected, and we know of no reason any nominee would be unable to serve. If any nominee for any reason becomes unable or unwilling to serve, the proxies will be voted for a substitute nominee designated by the Board.

The following table includes the names, ages as of April 17, 2025, committee memberships, and class for each of the director nominees and continuing directors.

Committee Memberships |

|||||||

Name |

Age |

Independent |

AC |

CC |

NCGC |

Class |

Term |

Craig Ashmore |

62 |

Class I |

Expiring at the 2028 Annual Meeting |

||||

Christian Cook |

54 |

· |

|||||

Leslie Heisz |

64 |

· |

· |

· |

|||

Alan Monié |

74 |

||||||

Bryan Kelln |

59 |

· |

Class II |

Expiring at the 2026 Annual Meeting |

|||

Mary Ann Sigler |

70 |

· |

|||||

Sharon Wienbar |

63 |

· |

· |

· |

|||

Eric Worley |

54 |

· |

|||||

Felicia Alvaro |

64 |

· |

C |

Class III |

Expiring at the 2027 Annual Meeting |

||

Paul Bay |

55 |

||||||

Jakki Haussler |

67 |

· |

· |

||||

Jacob Kotzubei |

56 |

C |

|||||

Matthew Louie |

47 |

C |

|||||

“AC” indicates Audit Committee, “CC” indicates Compensation Committee, “NCGC” indicates Nominating and Corporate Governance Committee, and “C” indicates Committee Chair

Our directors are elected by a “plurality” vote, meaning the nominees who receive the greatest number of “FOR” votes will be elected to the Board. The nominees receiving the greatest number of votes in an uncontested election will be elected. Abstentions that are not voted in this proposal will have no effect.

The Board Recommends a Vote “FOR” Each of the Four Nominees Named Above

2

Biographies of Nominees for Election to New Three-Year Terms that will Expire in 2028

Craig Ashmore

|

Director since October 2024 |

Committee(s) None |

Other Public Company Boards Current: None Past 5 Years: None |

Mr. Ashmore joined Platinum Advisors in 2014. Mr. Ashmore is currently a Managing Director at the firm and is responsible for senior level business development activities focused on identifying new acquisition opportunities. Prior to joining Platinum Advisors, Mr. Ashmore was Executive Vice President of Planning and Development at Emerson Electric Co. (NYSE: EMR), where he had responsibility for Emerson’s mergers and acquisitions, strategic planning and corporate technology functions as well as Emerson Network Power’s connectivity solutions business. He was a member of Emerson’s Office of the Chief Executive. Mr. Ashmore holds a Bachelor’s degree in Mechanical and Civil Engineering from the University of Connecticut and a Master’s degree in Business Administration from the Harvard Business School.

Mr. Ashmore was selected to serve on our Board due to his operational expertise and his experience related to private equity and transactional matters.

Christian Cook

|

Director since October 2024 |

Committee(s) Nominating and Corporate Governance |

Other Public Company Boards Current: None Past 5 Years: None |

Mr. Cook is currently a Managing Director at Platinum Advisors with responsibility for managing the transition of newly acquired companies into Platinum’s portfolio. Post-transition, he also has responsibility for strategy, value creation and operational performance at select global portfolio companies. Since his joining Platinum Advisors in 2013, Mr. Cook has served as an officer of a number of Platinum’s portfolio companies, notably Vertiv Holdings Co (NYSE: VRT), a manufacturer of technology and data center infrastructure equipment. Prior to joining Platinum Advisors, Mr. Cook was with AlixPartners where he focused on the operational improvements and cost reduction opportunities during high urgency situations, often serving interim C-suite roles such as CEO and COO. Mr. Cook holds a Bachelor of Mechanical Engineering degree from the Georgia Institute of Technology and holds a Master of International Business Studies degree from the University of South Carolina.

Mr. Cook was selected to serve on our Board due to his experience related to private equity, transactional matters, and operational performance on a global scale.

3

Leslie Heisz

|

Director since October 2024 |

Committee(s) Audit; Compensation |

Other Public Company Boards Current: Edwards Lifesciences; Capital Group Funds Past 5 Years: Public Storage (until 2024) |

Ms. Heisz served as managing director of Lazard Frères, a financial advisory firm and independent investment bank, from 2004 until her retirement in 2010, providing strategic financial advisory services for clients in a variety of industries. An experienced investment banking and corporate finance executive, Ms. Heisz previously held positions with Dresdner Kleinwort Wasserstein, Solomon Brothers, and PricewaterhouseCoopers. She currently serves on the boards of Kaiser Foundation Health Plan, Inc., and Kaiser Foundation Hospitals. Ms. Heisz holds a Bachelor of Science degree in Economics-Systems Science from UCLA and a Master of Business Administration degree from the UCLA Anderson School of Management.

Ms. Heisz was selected to serve on our Board due to her extensive experience as a public company director and audit committee member, her in-depth knowledge of capital markets, and her expertise in enterprise risk management, mergers and acquisitions, and numerous other finance and governance matters.

Alain Monié, Chairperson of the Board

|

Director since October 2024 |

Committee(s) None |

Other Public Company Boards Current: AES Corporation Past 5 Years: Expeditors International of Washington, Inc. (until 2020) |

Mr. Monié became a director and Chairperson of the Board in connection with the Company’s IPO in October 2024, at which time he retired as Executive Chairman of the Company, a capacity in which he had served since January 2022. Mr. Monié previously served as Ingram Micro’s Chief Executive Officer from January 2012 until January 2022. Mr. Monié initially joined Ingram Micro in February 2003 as Executive Vice President and served in that role and as President of Ingram Micro Asia-Pacific from 2004 to 2007, and then as President and Chief Operating Officer from 2007 to 2010. Prior to rejoining Ingram Micro as President and Chief Operating Officer in November 2011, he served as Chief Executive Officer of APRIL Management Pte., a multinational industrial company based in Singapore. Earlier in his career, Mr. Monié held a series of positions of increasing responsibility, across three continents, within Allied Signal Inc. and Honeywell International. Mr. Monié earned a Master’s degree in business administration from the Institut Supérieur des Affaires, France (now part of the HEC Group). He received high honors in automation engineering studies at the École Nationale Supérieure d’Arts et Métiers (ENSAM) France.

As a seasoned executive and former Chief Executive Officer of Ingram Micro, Mr. Monié was selected to serve on our Board due to his in-depth knowledge of Ingram Micro’s business operations and strategy that is important to the board of directors’ oversight of strategy, succession planning, enterprise risk management, compensation, and implementation of sound corporate governance practices.

4

Biographies of Continuing Directors Not Being Considered for Election at this Annual Meeting

The directors whose terms are not expiring in 2025 are listed below. They will continue to serve as directors for the remainder of their terms or through such other date, in accordance with the Company’s Amended and Restated Bylaws (“Bylaws”).

CLASS II Directors (with Terms Expiring in 2026)

Bryan Kelln

|

Director since October 2024 |

Committee(s) Compensation |

Other Public Company Boards Current: None Past 5 Years: Custom Truck One Source (until 2023); Verra Mobility (until 2021); Key Energy (until 2020) |

Mr. Kelln joined Platinum Advisors in 2008 and is a Partner and President of Portfolio Operations at the firm and is a member of the firm’s Investment Committee. Mr. Kelln is responsible for all aspects of business strategy and operations at the firm’s portfolio companies and is involved in evaluating buy- and sell-side opportunities across the firm. Mr. Kelln works closely with the firm’s operations team as well as portfolio company executive management to drive strategic initiatives and to deploy operational resources. Prior to joining Platinum Advisors, Mr. Kelln was Senior Vice President and Chief Operating Officer at Nortek, Inc. Previously Mr. Kelln was a senior executive at Jacuzzi Brands, Inc. where he served as President of Jacuzzi, Inc. and an Operating Executive with the Jordan Company, a private investment firm where he was involved in acquisitions, divestitures and operations for the firm and served as a board member of portfolio companies. Additionally, Mr. Kelln has also served as President and CEO of RockShox, Inc., Senior Vice President at General Cable Corporation and as a Partner in the Supply Chain Management Practice of Mercer Management Consulting. Mr. Kelln holds a Bachelor’s degree from Washington State University and a Master of Business Administration from The Ohio State University, Fisher College of Business.

Mr. Kelln was selected to serve on our Board due to his experience related to private equity, transactional matters, and post-acquisition monitoring and oversight of operational performance at portfolio companies.

Mary Ann Sigler

|

Director since July 2021 |

Committee(s) Compensation |

Other Public Company Boards Current: None Past 5 Years: Ryerson Holding Corporation (until 2024) |

Ms. Sigler is Executive Vice President and Treasurer of Platinum Advisors. She joined Platinum Advisors in 2004 and is responsible for overall accounting, tax and financial reporting, as well as managing strategic planning projects for the firm. Prior to joining Platinum Advisors, Ms. Sigler was with Ernst & Young LLP for 25 years where she was a partner. Ms. Sigler holds a Bachelor of Arts degree in Accounting from California State University at Fullerton and a Master’s degree in Business Taxation from the University of Southern California. Ms. Sigler is a Certified Public Accountant in California, as well as a member of the American Institute of Certified Public Accountants and the California Society of Certified Public Accountants.

Ms. Sigler was selected to serve on our Board due to her extensive and significant business, financial, and investment experience and prior involvement with Platinum’s investment in Ingram Micro.

5

Sharon Wienbar

|

Director since October 2024 |

Committee(s) Audit; Compensation |

Other Public Company Boards Current: Enovis Corporation; Resideo Technologies Past 5 Years: Covetrus (until 2022) |

Ms. Wienbar served as a partner of Scale Venture Partners, a venture capital firm investing in early-stage technology companies, from 2001 until her retirement in 2018. She also served as Chief Executive Officer of Hackbright Academy, a leading software development program for women, from 2015 until its acquisition in 2016. Prior to her career in venture capital, Ms. Wienbar held leadership roles at software companies, including Adobe Systems, after beginning her career at Bain & Company. She currently serves as a director of USRowing and Planned Parenthood Direct. Ms. Wienbar holds Bachelor of Science and Master of Science degrees in Engineering from Harvard University, as well as a Master of Business Administration degree from Stanford University.

Ms. Wienbar was selected to serve on our Board due to her service as a director for multiple public companies and her vast experience investing in technology companies and advising them on corporate strategy.

Eric Worley

|

Director since October 2024 |

Committee(s) Nominating and Corporate Governance |

Other Public Company Boards Current: None Past 5 Years: None |

Mr. Worley joined Platinum Advisors in 2001. Mr. Worley is currently a Managing Director at the firm and is responsible for financial due diligence and supporting the structuring and execution of acquisition and divestiture transactions. Post-acquisition, he also has responsibilities related to monitoring and oversight of financial performance at select portfolio companies. Since joining Platinum Advisors, Mr. Worley has served as an officer, director and member of the operating council for a number of Platinum’s privately held portfolio companies. Prior to joining Platinum Advisors, Mr. Worley was with Ernst & Young in its Transaction Support and Audit practices in Los Angeles and London. Mr. Worley holds a Bachelor’s degree in Accounting from Michigan State University and is a former Certified Public Accountant in the State of California.

Mr. Worley was selected to serve on our Board due to his experience related to private equity, transactional matters, and post-acquisition monitoring and oversight of financial performance on a global scale.

6

CLASS III Directors (with Terms Expiring in 2027)

Felicia Alvaro

|

Director since October 2024 |

Committee(s) Audit (Chair) |

Other Public Company Boards Current: None Past 5 Years: Cornerstone OnDemand (until 2021) |

Ms. Alvaro previously served as Chief Financial Officer, EVP and Treasurer for Ultimate Software from 2018 until her retirement in 2020, a period during which she oversaw the company’s transition in 2019 from a publicly traded company to a privately held company. Ms. Alvaro joined Ultimate Software as Vice President of Finance in 1998, shortly after the company’s IPO. During her 22-year tenure at Ultimate Software, she was responsible for the company’s accounting, finance, privacy, risk and compliance, financial planning, tax, treasury and financial systems teams. Previously, Ms. Alvaro spent 11 years in finance and accounting positions at Precision Response Corporation, Pueblo Xtra International and KPMG. Ms. Alvaro holds a Bachelor of Science in Accounting from Southeastern Louisiana University and is a Certified Public Accountant in Georgia.

Ms. Alvaro was selected to serve on our Board due to her decades of senior executive leadership experience and expertise in accounting, auditing, financial reporting, financial planning and analysis, risk oversight, and general compliance.

Paul Bay, Chief Executive Officer

|

Director since October 2024 |

Committee(s) None |

Other Public Company Boards Current: None Past 5 Years: None |

Mr. Bay assumed the role of Chief Executive Officer of Ingram Micro on January 1, 2022. Mr. Bay had served as Ingram Micro’s Executive Vice President and President of Global Technology Solutions since January 2020. Prior to that, he served as Ingram Micro’s Executive Vice President and Group President of the Americas from August 2018 to December 2019, Executive Vice President and Chief Executive of Ingram Micro U.S. and Miami Export from 2015 to August 2018, and Sr. Executive Vice President and President of Ingram Micro North America from 2013 to 2014. Mr. Bay first joined Ingram Micro in 1995 and served in various roles of increasing responsibility until 2006. Mr. Bay then served as CEO of Punch! from 2006 to 2010 and rejoined Ingram Micro in 2010. Mr. Bay holds a Bachelor’s degree in speech communication from California State University, Northridge.

Mr. Bay was selected to serve on our Board due to his extensive executive management expertise and a deep understanding of the technology sector and distribution industry, developed over decades of leadership experience within the company.

7

Jakki Haussler

|

Director since October 2024 |

Committee(s) Nominating and Corporate Governance |

Other Public Company Boards Current: Service Corporation International; Vertiv Holdings; Morgan Stanley Funds Past 5 Years: Barnes Group Inc. (until 2025); Cincinnati Bell (until 2021) |

Ms. Haussler serves as the Non-Executive Chairman of Opus Capital Management LLC, an investment advisory firm she co-founded in 1996 and where she served as Chief Executive Officer from 1996 to 2019. She also served as managing director of Capvest Venture Fund LP from 2000 to 2011 and as a partner at Adena Ventures LP from 1999 to 2010. Ms. Haussler, a former Certified Public Accountant, holds a Bachelor of Business Administration degree in Accounting from the University of Cincinnati and a Juris Doctor degree from the Salmon P. Chase College of Law at Northern Kentucky University.

Ms. Haussler was selected to serve on our Board due to her experience on several public company boards and her expertise in finance, accounting, portfolio management, and business development.

Jacob Kotzubei

|

Director since October 2024 |

Committee(s) Compensation (Chair) |

Other Public Company Boards Current: Ryerson Holding Corporation; Vertiv Holdings Past 5 Years: Key Energy (until 2022); Verra Mobility (until 2021); KEMET (until 2020) |

Mr. Kotzubei joined Platinum Advisors in 2002 and is a Partner and co-President at the firm. Prior to joining Platinum Advisors in 2002, Mr. Kotzubei was a Vice President of the Goldman Sachs Investment Banking Division – High Tech Group in New York City, and the head of the East Coast Semiconductor Group. Previously, he was an attorney at Sullivan & Cromwell LLP in New York City, specializing in mergers and acquisitions. Mr. Kotzubei received a Bachelor of Arts degree from Wesleyan University and holds a Juris Doctor from Columbia University School of Law.

Mr. Kotzubei was selected to serve on our Board due to his experience in executive management oversight, private equity, capital markets, mergers and acquisitions, and other transactional matters.

Matthew Louie

|

Director since October 2024 |

Committee(s) Nominating and Corporate Governance (Chair) |

Other Public Company Boards Current: Vertiv Holdings Past 5 Years: None |

Mr. Louie joined Platinum Advisors in 2008. Mr. Louie is a Managing Director at the firm and is responsible for the structuring and execution of acquisition and divestiture transactions. Prior to joining Platinum Advisors in 2008, Mr. Louie was an investment professional at American Capital Strategies, a middle-market focused private equity firm. Prior to American Capital, Mr. Louie worked in venture capital and growth equity at both Canaan Partners and Agilent Technologies, and in investment banking at Donaldson, Lufkin & Jenrette. Mr. Louie holds undergraduate degrees in both Economics and Political Science from Stanford University. He also holds a Master’s degree in Business Administration from Harvard Business School. Mr. Louie serves as a manager of a number of Platinum’s portfolio companies.

Mr. Louie was selected to serve on our Board due to his experience related to private equity, capital markets, transactional matters, and post-acquisition monitoring and oversight of operational performance at portfolio companies.

8

Board Composition

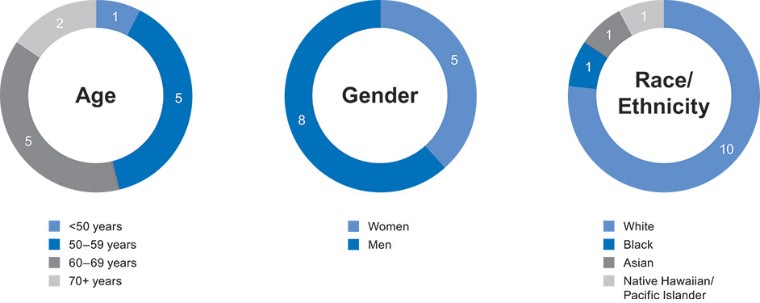

Our directors reflect diverse perspectives, including a complementary mix of skills, experience, and backgrounds that we believe are critical to the Board’s ability to represent the interests of the Company’s stockholders.

Skills and Experience Matrix

|

Alvaro |

|

Ashmore |

|

Bay |

|

Cook |

|

Haussler |

|

Heisz |

|

Kelln |

|

Kotzubei |

|

Louie |

|

Monié |

|

Sigler |

|

Wienbar |

|

Worley |

|

Other Public Company Boards |

· |

· |

· |

· |

· |

· |

· |

· |

· |

|||||||||||||||||

Current |

3 |

2 |

2 |

1 |

1 |

2 |

||||||||||||||||||||

Past 5 Years |

1 |

2 |

1 |

3 |

3 |

1 |

1 |

1 |

||||||||||||||||||

Executive Leadership |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

|||||||||||||

CEO Experience |

· |

· |

· |

· |

· |

· |

||||||||||||||||||||

CFO Experience |

· |

· |

||||||||||||||||||||||||

Public Company Executive Officer Experience1 |

· |

· |

· |

· |

· |

· |

||||||||||||||||||||

International Experience |

· |

· |

· |

· |

||||||||||||||||||||||

Financial Literacy |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

|||||||||||||

Public Financial Reporting |

· |

· |

· |

· |

· |

|||||||||||||||||||||

Financial Analysis |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

||||||||||||||||

Professional Services |

· |

· |

· |

· |

· |

· |

· |

· |

||||||||||||||||||

Audit Committee Financial Expert2 |

· |

· |

||||||||||||||||||||||||

Operations |

· |

· |

· |

· |

||||||||||||||||||||||

Technology |

· |

· |

· |

· |

· |

· |

· |

|||||||||||||||||||

Hardware/Software/Cloud |

· |

· |

· |

· |

||||||||||||||||||||||

Distribution |

· |

· |

· |

· |

· |

|||||||||||||||||||||

Mergers & Acquisitions |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

· |

1 |

Current or Former Section 16 Officer under applicable SEC rules |

2 |

Per designation by the Board |

Demographic Information

9

Corporate Governance

Board Governance

Board of Director Meetings

Our Board held one meeting during Fiscal Year 2024 after the IPO. Each director serving during our Fiscal Year 2024 attended 100% of the meetings held by the Board and the committees on which they serve. The Company expects that each director will attend our Annual Meeting.

Director Independence

As a “controlled company” within the meaning of the governance standards of the NYSE, we qualify for, and rely on, exemptions from certain corporate governance requirements, including the requirement that a majority of our Board consist of independent directors.

Our Board has affirmatively determined that Felicia Alvaro, Jakki Haussler, Leslie Heisz, and Sharon Wienbar do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) and the listing standards of the NYSE. In making these determinations, our Board considered the current and prior relationships that each such director has with our Company, Platinum and all other facts and circumstances our Board deemed relevant in determining their independence.

Board Leadership Structure

Our Bylaws and corporate governance guidelines provide our Board with the authority to separate or combine the positions of the Chairperson and Chief Executive Officer. At this time, the Board has determined that it is in the best interests of the Company and its stockholders to separate the roles, with Alain Monié serving as Non-Executive Chairperson and Paul Bay serving as Chief Executive Officer. Please refer to the other parts of this “Corporate Governance” section, and in particular “Risk Oversight,” for further discussion regarding our leadership structure.

Additional Board Service

Serving on the Board requires significant time and attention. Directors are expected to ensure that their other commitments do not materially interfere with their duties to the Company. Except as otherwise approved by the Board:

| ● | a director serving on the Company’s Board may not serve on the boards of more than five public companies (including the Company); |

| ● | an executive officer serving as a director on the Company’s Board may not serve on the boards of more than two public companies (including the Company); and |

| ● | a member of the Audit Committee may not serve on the audit committees of the boards of more than three public companies (including the Company). |

10

Communications with the Board

Our stockholders and other interested parties may communicate directly with the Board as a whole, a specific committee of the Board, or any individual director at the following address:

Ingram Micro Holding Corporation

3351 Michelson Drive, Suite 100

Irvine, CA 92612

Attn: Secretary

Our Company’s secretary will determine whether the communication is a proper communication to be forwarded to the Board, a committee, or any individual director. Please see our Policy Regarding Board Communications with Stockholders and Other Interested Parties under the “Governance Documents” sub-link on our investor relations website, https://ir.ingrammicro.com.

Committees of the Board of Directors

The Board has established three standing committees: an audit committee (the “Audit Committee”), compensation committee (the “Compensation Committee”), and nominating and corporate governance committee (the “Nominating and Corporate Governance Committee”). Additionally, the Board may form temporary committees as needed to address specific issues that arise between regular meetings or matters that do not fall under the purview of the standing committees.

Our Audit Committee meets the independence requirements set forth under NYSE listing standards. Platinum holds more than a majority of the voting power of our outstanding Common Stock entitled to vote generally in the election of our directors. As a result, we are a “controlled company” under the NYSE’s listing standards, and we qualify for, and rely on, exemptions from certain corporate governance requirements, including the requirements that our Compensation Committee and Nominating and Corporate Governance Committee be composed entirely of independent directors.

Each of the standing committees operates under a charter approved by the Board, copies of which can be found under the “Governance Documents” sub-link on our investor relations website, https://ir.ingrammicro.com/. Our Corporate Governance Guidelines are also available under the “Governance Documents” sub-link on our investor relations website.

Audit Committee

The primary purpose of the Audit Committee is to prepare the committee report required by the rules of the SEC and to assist the Board with its oversight of the Company’s risk management policies and procedures, the audits and integrity of the Company’s financial statements, the effectiveness of the Company’s internal controls over financial reporting, the Company’s compliance with legal and regulatory requirements, the qualifications, performance, and independence of the Company’s independent auditor, PricewaterhouseCoopers LLP (“PwC”), and the performance of the Company’s internal audit function.

The Audit Committee consists of the following individuals, each of whom the Board has determined is “independent” within the meaning of the NYSE listing rules: Felicia Alvaro (Chair), Leslie Heisz, and Sharon Wienbar. The Board has further determined that each of Felicia Alvaro and Leslie Heisz of the Audit Committee qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K. Furthermore, each Audit Committee member is financially literate, as such qualification is interpreted by the Board in its business judgment.

The Audit Committee met two times during Fiscal Year 2024 after the IPO.

11

Compensation Committee

The primary purposes of the Compensation Committee are to review and approve corporate goals and objectives relevant to the compensation of the CEO and the other senior executives of the Company, to evaluate the performance of the CEO and the other senior executives in light of such goals and objectives, to determine and approve the compensation of the CEO and the other senior executives, to make recommendations to the full Board with respect to incentive-based and equity-based compensation plans that are subject to Board approval, to prepare the disclosure required by the rules of the SEC, to review and report to the Board on the Company’s key strategic and human resource management issues, and to oversee the Company’s overall compensation structure, policies, and programs.

The Compensation Committee consists of the following members: Jacob Kotzubei (Chair), Leslie Heisz, Bryan Kelln, Mary Ann Sigler, and Sharon Wienbar. According to the exemptions for a “controlled company” set by the NYSE, the Compensation Committee is not required to consist solely of independent directors.

The Compensation Committee met one time during the Fiscal Year 2024 after the IPO.

Nominating and Corporate Governance Committee

The primary purposes of the Nominating and Corporate Governance Committee are to review and make recommendations to the full Board regarding the structure and composition of the Board and its committees, including identifying qualified director nominees consistent with criteria approved by the Board, to develop and recommend to the full Board corporate governance guidelines applicable to the Company, and to oversee the evaluation of the Board, its committees, and the Company’s management team.

The Nominating and Corporate Governance Committee consists of the following members: Matthew Louie (Chair), Christian Cook, Jakki Haussler, and Eric Worley. According to the exemptions for a “controlled company” set by the NYSE, the Nominating and Corporate Governance Committee is not required to consist solely of independent directors.

The Nominating and Corporate Governance Committee met one time during the Fiscal Year 2024 after the IPO.

Director Nomination Procedures

The Nominating and Corporate Governance Committee is responsible for reviewing the Board composition and ensuring that the Board is comprised of individuals who have distinguished records of leadership and success in their area of activity and who will make substantial contributions to the Board. In making this assessment, the Nominating and Corporate Governance Committee considers a variety of skills and characteristics of Board candidates including, but not limited to, relevant industry experiences, general business experience, and relevant financial experiences.

Specific consideration is given to:

| ● | Roles and contributions valuable to the business community; |

| ● | Personal qualities of leadership, character, and judgement, and reputation in the community at large of integrity, trust, respect, competence and adherence to the highest ethical standards; |

| ● | Relevant knowledge and experience in such things as business, technology, finance and accounting, marketing, international business, government, and other disciplines relevant to the success of a large publicly traded company; |

| ● | Ability to contribute to the diversity of skills, viewpoints, experiences, backgrounds, and demographic characteristics; and |

| ● | Whether the candidate is free of conflicts and has the time required for preparation, participation, and attendance at all meetings. |

12

Stockholder Nominees for Directors

Stockholders may recommend a director nominee to the Nominating and Corporate Governance Committee for election at the 2026 annual meeting of stockholders (the “2026 Annual Meeting”).

Stockholders may nominate director candidates in writing by following the notice procedures and providing the information required by our Bylaws, which includes delivering a notice to the Secretary of the Company at 3351 Michelson Drive, Suite 100 Irvine, CA, 92612, not earlier than the close of business on the 120th day prior to the first anniversary of the date of the preceding year’s annual meeting of stockholders nor later than the close of business on the 90th day prior to the first anniversary of the date of the preceding year’s annual meeting of stockholders. If the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, or if no annual meeting was held in the preceding year (other than for purposes of the Company’s first annual meeting) such stockholder’s notice to be timely must be so delivered not earlier than the close of business on the 120th day prior to the date of such annual meeting and not later than the close of business on the later of (i) the 10th day following the day the public announcement of the annual meeting is first made or (ii) the 90th day prior to the date of the annual meeting. Stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must also provide notice that sets forth the information required by Rule 14a-19 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) no later than April 6, 2026.

Such notice shall include the information required by our Bylaws as well as the following information for each nominee:

| ● | Name, age, business address, and residence address; |

| ● | Principal occupation or employment (present and for the past five years); |

| ● | Stock ownership information for such person and any member of the immediate family of such person, or any affiliate or associate of such person; |

| ● | Complete and accurate description of all direct and indirect compensation and other material monetary agreements, arrangements, and understandings between or among the nominating stockholders and each proposed nominee; and |

| ● | Any other information that must be disclosed about director nominees in proxy solicitations under Regulation 14A of the Exchange Act. |

The Nominating and Corporate Governance Committee will evaluate each director nominee in accordance with the same processes regardless of the source of the nomination and if appropriate, make recommendations to the board of the director nominees for selection.

13

Risk Oversight

Our Board is responsible for overseeing our risk management process. Our Board focuses on our general risk management strategy and the most significant risks facing us, and it oversees the implementation of risk mitigation strategies by management. Our Board is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters and significant transactions.

The following table summarizes the primary areas of risk management the Board and its committees exercise oversight:

Board / Committee |

Primary Areas of Risk Oversight |

Board of Directors |

Risks and exposures related to strategy, finance, and execution; risks associated with major acquisitions; CEO succession planning; crisis response; cybersecurity; sustainability considerations; and other matters that could pose significant risks to the Company |

Audit Committee |

Risks and exposures concerning financial reporting accuracy, internal controls, compliance, auditor independence, cybersecurity, and enterprise risk management |

Compensation Committee |

Risks and exposures related to executive and overall compensation and benefits, incentive structures, and general human capital management strategies |

Nominating and Corporate Governance Committee |

Risks and exposures concerning board composition, governance compliance, leadership succession, ethical conduct, and regulatory adherence |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board currently consists of, and at all times during Fiscal Year 2024 following the Compensation Committee’s creation in connection with the IPO consisted of, Mr. Kotzubei (Chair), Ms. Heisz, Mr. Kelln, Ms. Sigler, and Ms. Wienbar. No member of this committee was at any time during Fiscal Year 2024 an officer or employee of the Company, was formerly an officer of the Company or any of its subsidiaries, or had any employment relationship with the Company or any of its subsidiaries, except for Ms. Sigler who ceased to serve as the President and Treasurer of the Company upon the completion of the IPO. No executive officer of the Company has served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity, where one of such entity’s executive officers served as a director of the Company or a member of the Compensation Committee.

14

The Tenets of Our Success

Our dedication to a shared set of principles unites and guides us to better decisions and behaviors, enabling us to focus on the success of our business partners and associates.

|

Results |

Courage |

Integrity |

Responsibility |

Imagination |

Talent |

Governance Principles and Policies

We are committed to maintaining ethical and legal standards that reflect our deeply rooted values. This unwavering commitment is at the core of our corporate philosophy. We hold ourselves—our directors, officers, and associates—to the highest level of integrity, and that includes compliance with laws and regulations of the jurisdictions in which we operate. We also expect these high standards from third parties working on our behalf. All of this is represented by our core governance principles and policies summarized below.

Separate Chairperson and CEO roles |

The separation of roles of Chairperson and CEO enables the Chair to focus on managing the Board while allowing the CEO to maintain oversight of the day-to-day conduct of our business. |

Executive Sessions |

Our directors regularly meet in executive session without members of management present. The Chairperson of the Board typically presides at such executive sessions. |

Annual Board Self-Assessment |

Our Board conducts an annual self-assessment to determine whether it and its committees are functioning effectively. |

Executive Succession Plan |

Our Board annually reviews the executive succession planning process with the assistance of the Compensation Committee. |

No “Poison Pill” |

Our Board has not adopted a “poison pill.” |

Robust Stock Ownership Guidelines |

Our executives are subject to stock ownership guidelines, requiring them to hold 2X to 5X their respective base amount. |

Access to Management |

Our Board maintains interaction with senior management and has complete access to all members of management and other employees. |

Director Orientation and Continuing Education |

Our Board receives education programs on business operations, industry trends, and corporate governance practices. |

Time Commitment Policy |

Our directors must obtain specific approval from the Board before serving on other boards, and in general, no director may simultaneously serve on more than five public company boards (or more than two public company boards, including the Company’s, if such director is an executive officer of a public company). |

15

Insider Trading Policy

With respect to Item 408(b) of Regulation S-K, the Company has also

Code of Ethics

With respect to Item 406 of Regulation S-K, we have adopted a Code of Conduct (“Code of Conduct”) that applies to all of our directors, officers, and team members, including our CEO, our chief financial officer, and our chief accounting officer, and a Code of Ethics for Principal Financial Officers that applies to our CEO, chief financial officer, chief accounting officer, controller, treasurer, and other individuals performing similar functions (“PFO Code of Conduct”). Our Code of Conduct and PFO Code of Conduct are each available on our website, and they constitute a “code of ethics” as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to, or waivers of, provisions thereof on our website.

Compensation Recovery Policies

In connection with the IPO, we adopted the Policy for the Recovery of Erroneously Awarded Compensation (the “Required Clawback Policy”), a policy intended to comply with the applicable SEC and NYSE rules relating to the recoupment of incentive compensation. The Required Clawback Policy describes the circumstances in which current and former executive officers of the Company will be required to repay or return to the Company erroneously awarded compensation. In general, as provided in the Required Clawback Policy, such circumstances include an accounting restatement that results in an executive officer having received more incentive compensation during the three completed fiscal years preceding the date of the accounting restatement than would have been received had such compensation been determined based on the restated amounts.

In addition to the Required Clawback Policy, we continue to maintain the Compensation Recovery Policy (the “Discretionary Clawback Policy”), last revised in 2017, that is applicable to our NEOs (as defined below) as well as other key executives (each, a “Covered Employee”). The Discretionary Clawback Policy authorizes the Board, in its sole discretion, to recover incentive compensation earned and received or realized in the 36 months preceding the date that a “recoverable event” (as defined in the Discretionary Clawback Policy to include a Covered Employee’s engagement in certain conduct that is detrimental to us or the calculation, grant, vesting, and/or payment of any incentive compensation that is based on materially inaccurate financial results or performance metric criteria) is determined to have occurred.

The Board believes that it is in the best interests of the Company and its stockholders to maintain the Discretionary Clawback Policy in addition to the Required Clawback Policy.

Sustainable Impact

Our sustainable impact program is overseen by an executive steering committee consisting of our:

| ● | Chief Executive Officer, |

| ● | Executive Vice President and Chief Financial Officer, |

| ● | Executive Vice President, Secretary and General Counsel, |

| ● | Executive Vice President, Human Resources, and |

| ● | Executive Vice President, Global Operations and Engineering. |

16

This executive steering committee receives periodic briefings from our global sustainability team and individual program owners. Responsibility is one of the Tenets of Our Success as a company, and environmental stewardship is one area in which we demonstrate our responsibility. We have established targets for reducing greenhouse gas (“GHG”) emissions and waste in our operations. In December 2024, Ingram Micro received approval from the Science Based Targets initiative for its near-term climate targets, including its goal to reduce absolute Scope 1 and 2 GHG emissions by 90% by 2030, using a 2022 base year.

To support a circular economy, our Information Technology Asset Disposition (“ITAD”) business focuses on the reuse and recycling of electronics, and, as of December 28, 2024, a total of five of our ITAD processing facilities held e-Stewards certifications, four of which were in North America. Since 2019, we have been a registered SmartWay Shipper Partner in the Environmental Protection Agency’s SmartWay Program, which allows us to benchmark our performance and assess the environmental impact of our transportation in the United States, as well as measure the fuel efficiency of our carrier partners, helping us address the carbon impacts of goods movement within our value chain.

In early 2024 and again in early 2025, the Company’s broad-based sustainability efforts were recognized by EcoVadis, a well-known third-party provider of evidence-based business sustainability assessments, who gave Ingram Micro a Platinum medal rating, reserved for the top one percent of the more than 125,000 companies on its platform. We believe this recognition signifies a substantial validation of our company’s commitment and leadership in sustainable and responsible business operations.

Cybersecurity

Our business operations rely on the secure processing, storage, integrity, and transmission of business-critical information, including transaction information as well as personal and other sensitive data, through digital and interconnected systems, including those of our service providers and other third parties. In order to identify, prevent, respond to, and mitigate cybersecurity risks, we maintain a formal data protection program with physical, technical, and administrative safeguards (the “Program”), which is integrated into our overall risk management processes.

Our Board maintains active oversight of cybersecurity risks through a structured governance framework:

| ● | The full Board receives comprehensive cybersecurity briefings at least annually, supplemented by sessions focused on emerging threats and Program strategy. |

| ● | The Audit Committee receives regular updates (typically quarterly) that cover, among other topics, performance against operational metrics and results of recent audits and assessments. |

| ● | Our Chief Information Security Officer (“CISO”), under the direction of our Executive Vice President and President – Global Platform Group, leads our Program, working with key stakeholders and resource groups, including industry groups, peer institutions, internal committees (the Information Security Management Committee), and law enforcement, as needed, to understand, identify, and address cybersecurity risks. Our CISO maintains direct reporting access to the Board, ensuring that time-sensitive matters may be escalated as needed. |

| ● | Our internal audit team is responsible for testing key IT controls, while leaders from our legal, finance, communications, and risk management teams participate in incident response training, including annual tabletop exercises, to ensure swift and effective responses to cybersecurity incidents. |

17

Proposal 2: Advisory Vote on Executive Compensation

In accordance with Section 14A of the Exchange Act, stockholders are entitled to vote to approve, on a non-binding advisory basis, the compensation of our NEOs and our compensation philosophy, policies and practices as defined and disclosed further below in “Executive and Director Compensation—Compensation Discussion and Analysis,” which we encourage our stockholders to read.

This proposal, commonly known as a “say-on-pay" proposal, gives our stockholders the opportunity to express their views on compensation for our NEOs. This vote is not intended to address specific items of compensation, but rather the overall compensation of NEOs and philosophies, policies, and practices as described in this Proxy Statement.

Our executive programs and policies described are designed to incentivize, retain, and reward our executives for superior short- and long-term performance for our company and stockholders.

At the Annual Meeting we will ask our stockholders to approve the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as described in the Company’s proxy statement for the 2025 Annual Meeting of Stockholders pursuant to Item 402 of Regulation S-K and other compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion & Analysis, the 2025 Summary Compensation Table, and the other compensation-related tables and disclosure.”

We are asking that our stockholders indicate their support for our executive compensation as described in this Proxy Statement. While this say-on-pay vote is advisory and non-binding, the Compensation Committee will review the outcome of this vote and consider it when reviewing our compensation program and policies.

The Board Recommends a Vote “FOR” the Approval of the Compensation of our Named Executive Officers

18

Proposal 3: Frequency of the Advisory Vote on Executive Compensation

Section 14A of the Exchange Act requires that we provide our stockholders with the opportunity to indicate how frequently we should seek a “say-on-pay" vote. By voting on this proposal, stockholders may indicate whether the vote on executive compensation should occur every one year, two years, or three years. Stockholders may also abstain from voting on this proposal.

After careful consideration of this proposal, the Board has determined that an advisory vote on executive compensation occurring once every year is the most appropriate for the Company. The Board considered that an annual advisory vote on executive compensation—allowing our stockholders to provide input on our executive compensation program every year—is consistent with the Company’s efforts to engage our stockholders on executive compensation and corporate governance matters.

Because this vote is advisory and non-binding, the Board may decide that it is in the best interests of the stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than the option preferred by our stockholders.

The Board Recommends a Vote for “ONE YEAR” as the Preferred Frequency for Advisory Votes on Executive Compensation

19

Executive and Director Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis reviews the compensation provided to our Chief Executive Officer, our Chief Financial Officer and our three other most highly compensated officers who served as executive officers during Fiscal Year 2024 (collectively, the named executive officers, or “NEOs”), as determined under the rules of the SEC and set forth in the Summary Compensation Table.

Our NEOs for Fiscal Year 2024 were:

Executive Officer |

|

Position as of December 28, 2024 |

Paul Bay |

Chief Executive Officer (“CEO”) |

|

Michael Zilis |

Chief Financial Officer (“CFO”) |

|

Scott Sherman |

Executive Vice President, Human Resources (“EVP HR”) |

|

Augusto Aragone |

Executive Vice President, Secretary & General Counsel |

|

Alain Monié |

Former Executive Chairman (Retired on October 24, 2024) |

Executive Summary

Decisions Regarding Material Elements of Compensation

Following our IPO in October 2024 and our concurrent establishment of the Compensation Committee, all decisions regarding compensation to be paid to the CEO and each of the other NEOs have been made, and will continue to be made, by the Compensation Committee. Prior to our IPO in October 2024, all determinations relating to the components and amounts of compensation paid to our CEO and Executive Chairman for Fiscal Year 2024 were approved by the Board, and all recommendations relating to the components and amounts of compensation paid to our other NEOs for Fiscal Year 2024 were made by the CEO and approved by the Board.

The following summarizes the decisions made in Fiscal Year 2024 regarding the material elements of 2024 compensation.

| ● | Review of Base Salary. Salaries are reviewed annually by the CEO and EVP HR to ensure they are externally competitive, reflect individual performance, and are internally equitable relative to our other executives. Following the CEO’s and EVP HR’s discussion with the Board, and consideration of market conditions and other factors, no adjustments were made to base salary for any NEO in 2024. |

| ● | Establishing Challenging Targets to Differentiate Payments Under Our Annual Executive Incentive Program (“EIP”). The EIP is a short-term incentive plan under which participants can earn annual cash payments based on annual company, business unit and/or functional performance, as well as individual performance. The Company’s 2024 non-GAAP EBITDAR performance, $1,300.8 million, was above the non-GAAP EBITDAR threshold, $1,198.5 million, and below the non-GAAP EBITDAR target, $1,410.0 million, which resulted in the funding of the pool for the Fiscal Year 2024 EIP (the “EIP Pool”) at 74.19%. The EIP Pool was further distributed to plan participants, including each participating NEO, individually taking into consideration their contribution to the strategic plan, as well as achievement of annual goals and individual performance considerations. The individual payments to our CEO and the other NEOs (other than Mr. Monié who was not eligible for the EIP with respect to Fiscal Year 2024) are discussed further below and were each approximately 76% of the respective NEO’s target annual EIP incentive (including the management-by-objective (“MBO”) portion). |

20

| ● | Equity Awards and Prior Participation Plan. At the time of our IPO, our NEOs were granted restricted stock units (“RSUs”) and performance-based restricted stock units (“PSUs”) under our 2024 Stock Incentive Plan (the “2024 Plan”). Prior to our adoption of the 2024 Plan, the Ingram Micro Holding Corporation (formerly Imola Holding Corporation) 2021 Participation Plan (the “Participation Plan”) was the long-term incentive program used to incentivize key associates, including our NEOs (other than Mr. Monié), from 2021 until the IPO in October 2024. Prior to the IPO, the Participation Plan was terminated by the Board, and our NEOs were granted the RSUs and PSUs. The granted PSUs have the same performance vesting conditions as the performance-vested units under the terminated Participation Plan. |

| ● | Transition Agreement with Mr. Monié. In connection with his transition from CEO to Executive Chairman as of January 1, 2022, and his subsequent retirement as of October 24, 2024, Mr. Monié received an RSU grant worth $2 million that immediately vested at the time of the IPO. A summary of his transition agreement, which was amended three times since it was first entered into on October 2, 2021, is included in “Mr. Monié Transition Agreement” found later in this “Compensation Discussion and Analysis.” |

Focus on Long-Term Value Creation

At executive management levels, compensation focuses on long-term shareholder value creation, reflecting our NEOs’ responsibility for setting and achieving long-term strategic goals. In support of this responsibility, compensation is heavily weighted toward variable compensation with a focus on long-term incentives. The units granted under our Participation Plan in July 2021 represented a significant portion of long-term compensation payable to our NEOs (other than Mr. Monié) upon achieving certain performance requirements. At the time of the IPO, such performance requirements under the Participation Plan had not been satisfied, and the Participation Plan was canceled, contingent upon the completion of the IPO. The RSUs and PSUs granted under the 2024 Plan in connection with the IPO are subject to, with respect to the RSUs, multi-year vesting conditions and, with respect to the PSUs, the achievement of certain financial targets to align our NEOs’ interests with those of Platinum. A portion of the RSUs granted to our NEOs vested immediately upon the IPO in recognition of our NEOs’ efforts in completing the IPO, a significant milestone for the Company.

Pay-for-Performance and CEO Compensation

We emphasize pay-for-performance with performance-based compensation, including annual EIP awards, PSUs granted under the 2024 Plan, and the prior 2021 Participation Plan awards. At the time Fiscal Year 2024 compensation decisions were made in early 2024, the Participation Plan had been in place for three years and progress had been made toward achieving the requisite performance thresholds. Because no new long-term incentive compensation awards were granted, performance-based compensation for Fiscal Year 2024 was intended to be limited to the EIP, which constituted 71% of our CEO’s total target annual cash compensation and 46% to 55% of each of our other NEO’s total target annual cash compensation for 2024, excluding Mr. Monié who was not eligible to participate in the EIP in 2024. In connection with the IPO, later in the year, the RSU and PSU grants were made to the NEOs, excluding Mr. Monié, after the Participation Plan and the awards thereunder had been canceled.

Focus on Best Practices

Our leadership team and Board, and our Board and Compensation Committee following our IPO, periodically examine our executive compensation practices in an effort to align them with best practices and evolving trends. For example (and as described further below):

| ● | We maintain clawback policies that provide for the repayment of incentive and/or severance compensation in appropriate circumstances, including a clawback policy as required by the final Dodd-Frank Rules and the applicable SEC and NYSE exchange listing requirements; |

| ● | Awards under our short-term and long-term incentive plans are capped to limit “windfalls;” |

21

| ● | None of the NEOs has an employment agreement; however, Mr. Monié was party to a transition agreement as further discussed in “Mr. Monié Transition Agreement” below; |

| ● | Benefits and perquisites are generally not provided to NEOs beyond the level provided to all other levels of management; |

| ● | The CIC Plan (as defined below) does not automatically accelerate vesting, requires a “double trigger” before benefits are paid, and does not have any provision for tax gross ups; |

| ● | The Board (and/or the Compensation Committee, as applicable) has retained and will consult with its independent outside compensation consultants on a regular basis and has sole discretion to engage or terminate its compensation consultants and other advisors; |

| ● | NEOs are subject to significant stock ownership guidelines; |

| ● | The Company’s insider trading policy prohibits its associates (including our executive officers and directors) from using Company stock in hedging transactions, engaging in short sales of Company securities, holding Company securities in a margin account, or having Company securities pledged as collateral for a loan; and |

| ● | Repricing of options is not permitted without the consent of stockholders. |

Overall Design and Rewards of the Executive Compensation Program

Design Elements

The broad objectives and key features of each element of the 2024 executive compensation program were as follows:

Compensation Element |

|

Objectives |

|

Key Features |

Base Salary |

Links performance and pay by providing competitive levels of base salary for each NEO based on the NEO’s role and responsibilities. Used to attract and retain executive talent in a very competitive marketplace. |

Reflects:

•

Peer market median range for positions with similar responsibilities and business size, and

•

An NEO’s responsibilities and performance, as demonstrated over time.

Salaries are reviewed annually to ensure they are externally competitive, reflect individual performance and are internally equitable relative to our other executives. |

22

Annual Executive Incentive Program, including the Strategic Objectives thereunder |

Provides incentives to focus our NEOs on the actions necessary to achieve the approved annual business plan.

Identifies what is expected for the year from the standpoint of corporate, business unit, regional and country results. Additionally, specific individual objectives and other strategic MBO goals provide focus on strategic projects that often deliver positive results over future years.

Links reward to accomplishment of goals within executives’ control and encourages both profitable growth and operating efficiency. |

Establishes incentive targets as a percentage of each NEO’s base salary that approximate the median market practice of comparable positions at comparator peer group companies. Each participating NEO has an individual MBO target that is 20% of the NEO’s EIP target. Achievement against the MBO component is capped at 100% of the MBO target. EIP payouts depend on meeting certain performance targets and specified strategic objectives over the course of a one-year performance period. Achievement against the EIP target is capped at 200% of the EIP target.

Performance targets and results vary among our NEOs to reflect appropriate differences in their responsibilities, as well as their individual performance. |

||

Equity-Based Long-Term Incentive Award Program |

Performance metrics align the performance goals of our NEOs with those of our stockholders to increase value.

Rewards stock price appreciation and ties wealth accumulation to performance. |

RSU and PSU grants upon the IPO were made in part to reward our NEOs for consummation of the IPO and to further incentivize shareholder value creation. |

||

Participation Plan |

Tie NEO long-term incentive compensation solely to Platinum’s achievement of certain multiples of invested capital.

The Participation Plan and all awards under the plan were terminated prior to the IPO. |

No grants were made under this program to any NEO since the initial awards in 2021. This was a long-term incentive program using time-vested and performance-based units, with performance-vested awards subject to achievement of shareholder profit and multiple of invested capital (“MOIC”) gains. |

||

Benefits and Perquisites |

Provide market competitive benefits to all associates, with limited special perquisites to NEOs. |

NEOs participate in our broad-based health and welfare, life insurance, disability, and retirement programs for management associates. We provide officers and other executive leadership in the U.S. (including our NEOs) with executive physical examinations. |

23

Design Principles

We believe a significant portion of NEO compensation should be at risk and subject to our financial performance. The only non- performance-based elements of our NEO compensation are base salaries, our employee benefit programs that are generally available to all management associates, and the RSUs that were awarded in connection with the IPO, a significant milestone for the Company. The remainder of compensation must be earned through the attainment of predetermined financial or strategic performance objectives. Compensation programs are designed to align the financial interests of our NEOs with those of our owners by providing appropriate short-and long-term financial incentives that reward executives for achieving objectives that enhance shareholder value. Our key design principles include:

| 1. | Target executive compensation with reference to the market median (50th percentile) for each element of pay and in total to be competitive with other employment opportunities. |

| ● | A competitive compensation program is critical in attracting, retaining, and motivating our senior leadership in order to achieve our long-term business and financial objectives. |

| ● | In late 2023, our Board engaged Compensia, an outside executive compensation consultant, to review the comparator peer group they had previously assisted us in selecting and to confirm whether any modifications were necessary or advisable for Fiscal Year 2024. The peer group consisted of the following group of 17 publicly traded companies, with one company, GXO Logistics, being removed from the prior peer group due to the Company’s divestiture of the business that had competed with GXO Logistics. |

Technology Distributors |

|

Other Distributors |

|

Broader Tech Ecosystem |

|

•

Arrow Electronics, Inc.

•

Avnet, Inc.

•

CDW

•

Insight Enterprises, Inc.

•

TD Synnex Corporation

|

•

Archer-Daniels-Midland

•

Bunge

•

Cardinal Health

•

Cencora, Inc.

•

McKesson Corporation

•

Performance Food Group

•

Sysco

•

United Natural Foods

•

W.W. Grainger, Inc.

•

WESCO International, Inc.

|

•

Best Buy

•

DXC Tech

|

| ● | Compensia was also engaged in late 2023 to benchmark NEO compensation against SEC filings of the peer group and the Radford Global Compensation Database including public and private U.S. companies with annual revenues between $12.5 billion and $50 billion. |

| ● | The management analysis and compensation report prepared by Compensia examined the competitiveness of our executive compensation programs in total and by each element of compensation (base salary, annual incentives and long-term incentives). In doing so, the value of each NEO’s compensation elements was compared to median information available from the survey sources and defined comparator group. Benefits and perquisites were not included in the 2023 report as they represent a small portion of our NEOs’ total remuneration. |

| 2. | Importance of Internal Pay Equity. Balancing competitiveness with internal equity helps support management development and movement of talent worldwide throughout the Company. Differences in actual compensation among associates in similar positions will reflect individual performance, future potential and business results. This effort also helps us promote talented leaders to positions with increased responsibilities and provides meaningful developmental opportunities. |

24

| 3. | Pay-for-Performance. We emphasize pay-for-performance, as indicated above under “Focus on Long-Term Value Creation.” With the introduction of the Participation Plan awards in 2021, we ceased granting new awards to the NEOs under the then-existing cash-based long-term incentive programs. At the time Fiscal Year 2024 compensation decisions were made, new performance-based compensation awards were limited to the EIP for Fiscal Year 2024 and constituted 71% of our CEO’s total target annual cash compensation and 46% to 55% of each of our other NEO’s 2024 total target annual cash compensation, excluding Mr. Monié who was not eligible for the EIP for Fiscal Year 2024. This performance-based compensation did not include the potential value of units granted under the terminated Participation Plan in 2021 or the RSUs and PSUs granted to our NEOs in connection with the IPO. The valuation of the RSUs and PSUs granted in connection with the IPO in October 2024 is explained in further detail later in this “Compensation Discussion and Analysis.” |

What is Rewarded

Executive compensation is designed to reward achievement of targeted financial results and individual performance. Our performance metrics are generally based on financial results, excluding restructuring charges, integration and transition costs directly related to acquisitions and implementation of cost-reduction programs and the impacts of any unplanned acquisitions. These metrics are regularly used by our management internally to understand, manage and evaluate our business and make operating decisions. The following table defines each performance metric used in 2024 as an executive incentive measure and states why the metric was selected and the compensation programs which use that metric. The Compensation Committee will identify, review, and approve the financial metrics to be used in the future for each of our performance-based components of compensation.

Metric |

|

Definition |

|

Why Selected |

|

Pay Programs |

Non-GAAP EBITDAR |

Non-GAAP foreign exchange neutral (FXN) earnings before interest, taxes, depreciation, amortization and restructuring or other similar costs as defined by management and approved by the Board. |

Performance metrics align the long-term goals of our executives with those of our owners to increase value. |

Annual Executive Incentive Program |

|||

Multiple of Invested Capital |

MOIC measures the total of the return on invested capital achieved by Platinum relative to the total of all capital or other contributions made by Platinum upon a “Qualifying Event.” |

Ties NEO long-term incentive compensation to the achievement of certain returns for Platinum, incentivizing shareholder value creation. |

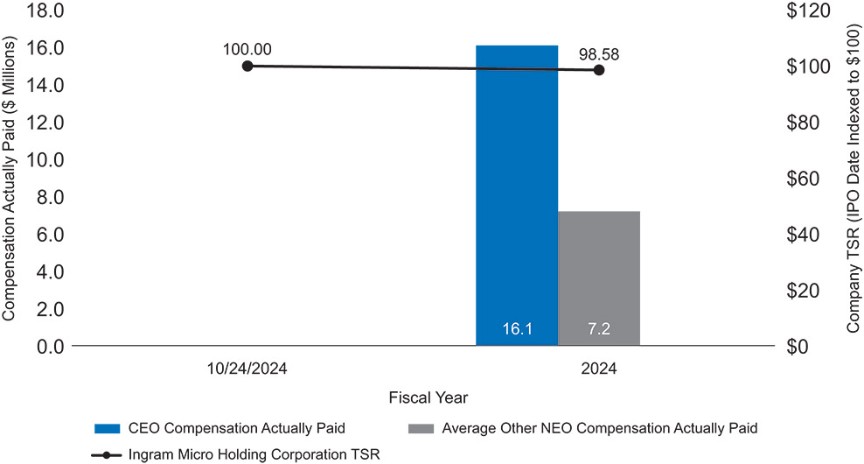

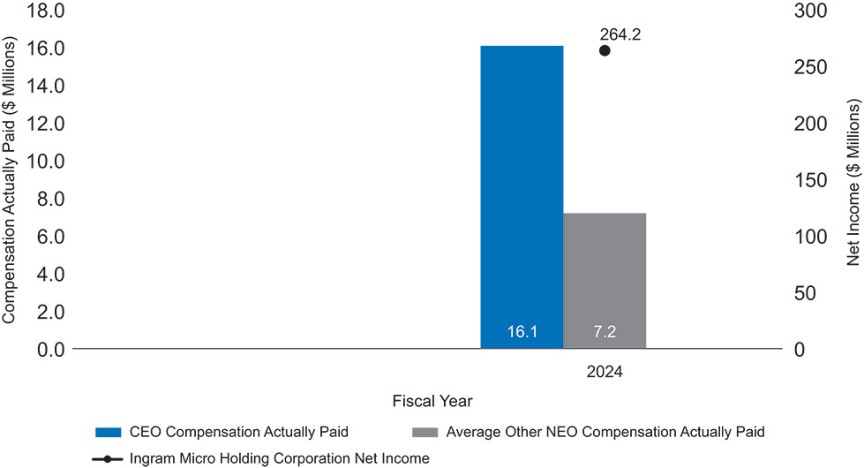

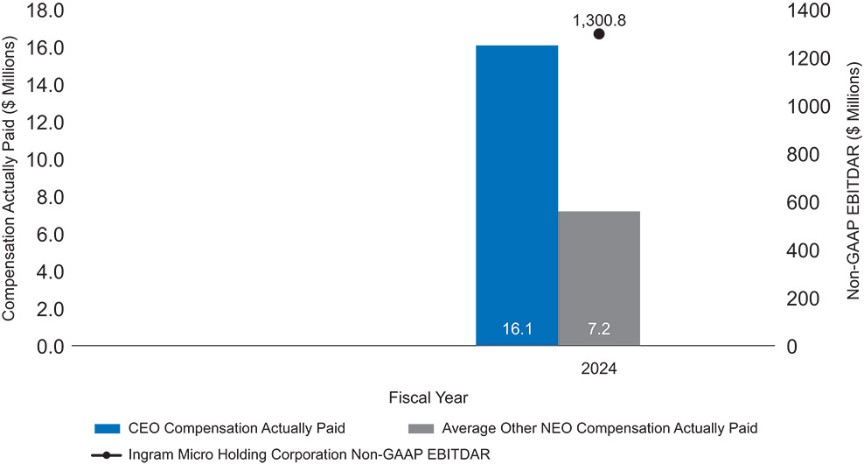

PSUs under the 2024 Plan