S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on October 15, 2024

Table of Contents

As filed with the Securities and Exchange Commission on October 15, 2024.

Registration No. 333-282404

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

INGRAM MICRO HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 5045 | 86-2249729 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3351 Michelson Drive, Suite 100

Irvine, CA 92612

Telephone: (714) 566-1000

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

Paul Bay

Chief Executive Officer

3351 Michelson Drive, Suite 100

Irvine, CA 92612

Telephone: (714) 566-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Cristopher Greer, Esq. Anne L. Barrett, Esq. Willkie Farr & Gallagher LLP 787 Seventh Avenue New York, New York 10019-6099 (212) 728-8000 |

Augusto Aragone, Esq. General Counsel 7509 NW 99th Avenue Doral, FL 33178 (786) 547-6045 |

James J. Clark, Esq. William J. Miller, Esq. Meghan McDermott, Esq. Cahill Gordon & Reindel LLP 32 Old Slip New York, NY 10005 (212) 701-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

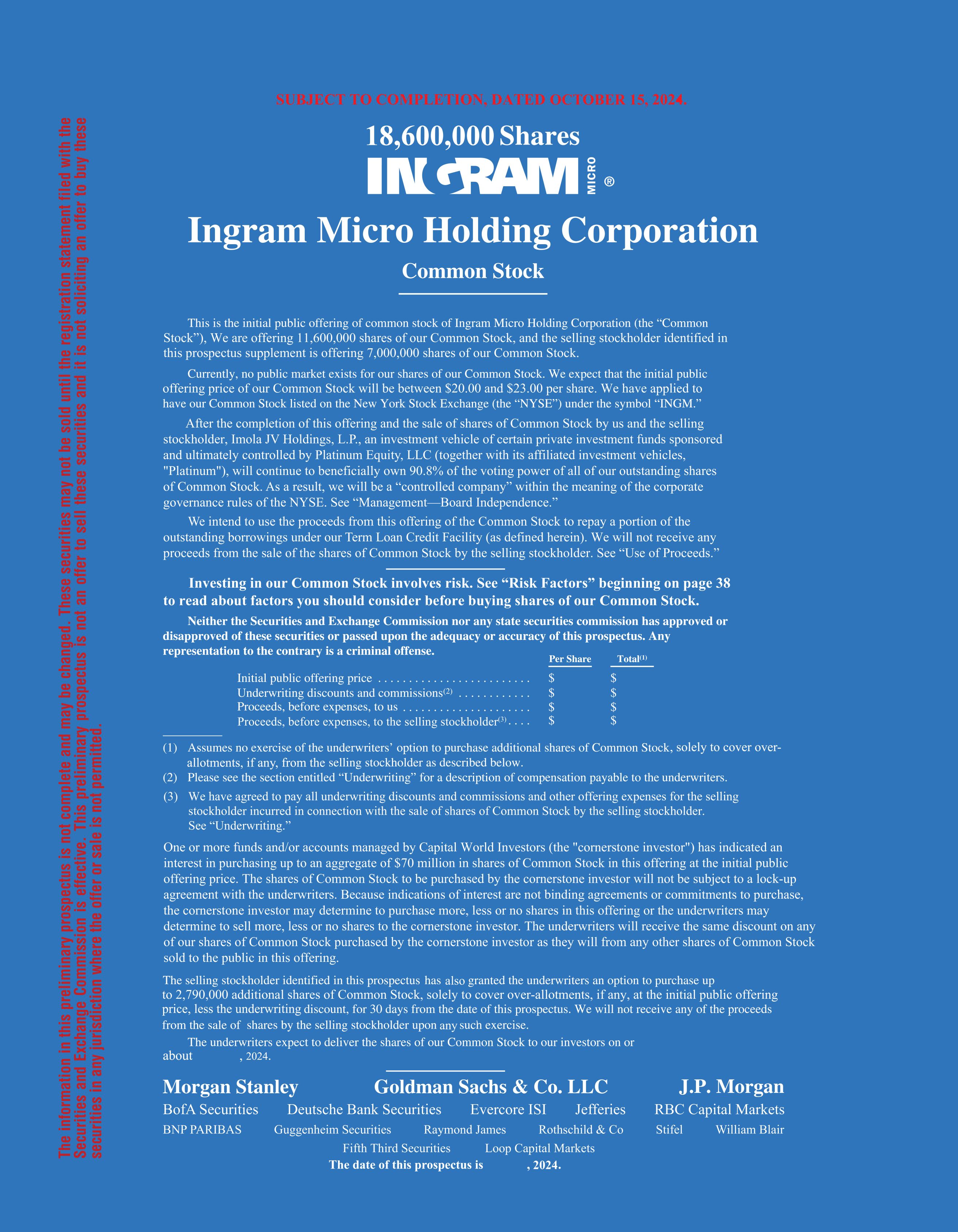

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED, 2022. Shares MICRO Ingram Micro Holding Corporation Common Stock This is the initial public offering of common stock of Ingram Micro Holding Corporation (the Common Stock). We are offering shares of our Common Stock. Currently, no public market exists for our shares of our Common Stock. We expect that the initial public offering price of our Common Stock will be between $and $per share. We have applied to have our Common Stock listed on the New York Stock Exchange (the NYSE) under the symbol INGM. After the completion of this offering, Imola JV Holdings L.P., an investment vehicle ultimately controlled by Platinum Equity, LLC, will continue to beneficially own % of the voting power of all of our outstanding shares of Common Stock. As a result, we will be a controlled company within the meaning of the corporate governance rules of the NYSE. See ManagementBoard Independence. We intend to use the proceeds from this offering of the Common Stock to repay a portion of the outstanding borrowings under our Term Loan Credit Facility (as defined herein). See Use of Proceeds. Investing in our Common Stock involves risk. See Risk Factors beginning on page 38 to read about factors you should consider before buying shares of our Common Stock. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. Per Share Total(1) Initial public offering price $$ Underwriting discounts and commissions(2)$$Proceeds, before expenses, to us $ $ (1) Assumes no exercise of the underwriters option to purchase additional shares of Common Stock from the selling stockholder as described below.(2) Please see the section entitled Underwriting for a description of compensation payable to the underwriters. The selling stockholder identified in this prospectus has granted the underwriters an option to purchase up to additional shares of Common Stock, at the initial public offering price, less the underwriting discount, for 30 days from the date of this prospectus. We will not receive any of the proceeds from the sale of shares by the selling stockholder upon such exercise. The underwriters expect to deliver the shares of our Common Stock to our investors on or about,. Morgan Stanley Goldman Sachs & Co. LLC J.P. Morgan The date of this prospectus is , 2022.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| ii | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| vi | ||||

| 1 | ||||

| 38 | ||||

| 79 | ||||

| 81 | ||||

| 83 | ||||

| 85 | ||||

| 86 | ||||

| 88 | ||||

| 90 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

96 | |||

| 152 | ||||

| 176 | ||||

| 184 | ||||

| 207 | ||||

| 211 | ||||

| 213 | ||||

| 218 | ||||

| 227 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

229 | |||

| 233 | ||||

| 249 | ||||

| 250 | ||||

| 251 | ||||

| F-1 |

i

Table of Contents

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we nor the selling stockholder nor the underwriters have authorized anyone to provide you with different information. The Company, the selling stockholder and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sales of shares of our Common Stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We are not, the selling stockholder is not and the underwriters are not, making an offer to sell shares of our Common Stock in any jurisdiction where the offer or sale is not permitted. Neither we nor the selling stockholder nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of shares of Common Stock and the distribution of this prospectus outside the United States.

Within this prospectus, we reference information and statistics regarding the IT industry. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources. Some data and other information contained in this prospectus, including, without limitation, reports from International Data Corporation (IDC), Technavio and Statista, are also based on managements estimates and calculations, which are derived from our review and interpretation of internal company research, surveys and independent sources in the markets in which we operate, which, in each case, we believe are reliable. Data regarding the industries in which we operate and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within these industries. Market share data is subject to change and cannot always be verified with certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. In addition, customer preferences can and do change. References herein to our being a leader in a market or product category refers to our belief that we have a leading market share position in each specified market, unless the context otherwise requires. While we believe such information is reliable, we have not independently verified any third-party information. While we believe our internal company research, surveys and estimates are reliable, such research, surveys and estimates have not been verified by an independent source. In addition, assumptions and estimates of our and our industries future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in Risk Factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. See Cautionary Note Regarding Forward-Looking Statements.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus contains some of our trademarks, service marks and trade names, including, among others, Ingram Micro, the Ingram Micro logo, V7 (Video Seven), CloudBlue, Aptec, Xvantage and Trust X Alliance. Each one of these trademarks, service marks or trade names is either (i) our registered trademark, (ii) a trademark for which we have a pending application, (iii) a licensed trademark or (iv) a trade name or service mark for which we claim common law rights. All other trademarks, trade names or service marks of any other

ii

Table of Contents

company appearing in this prospectus belong to their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are presented without the TM, SM and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

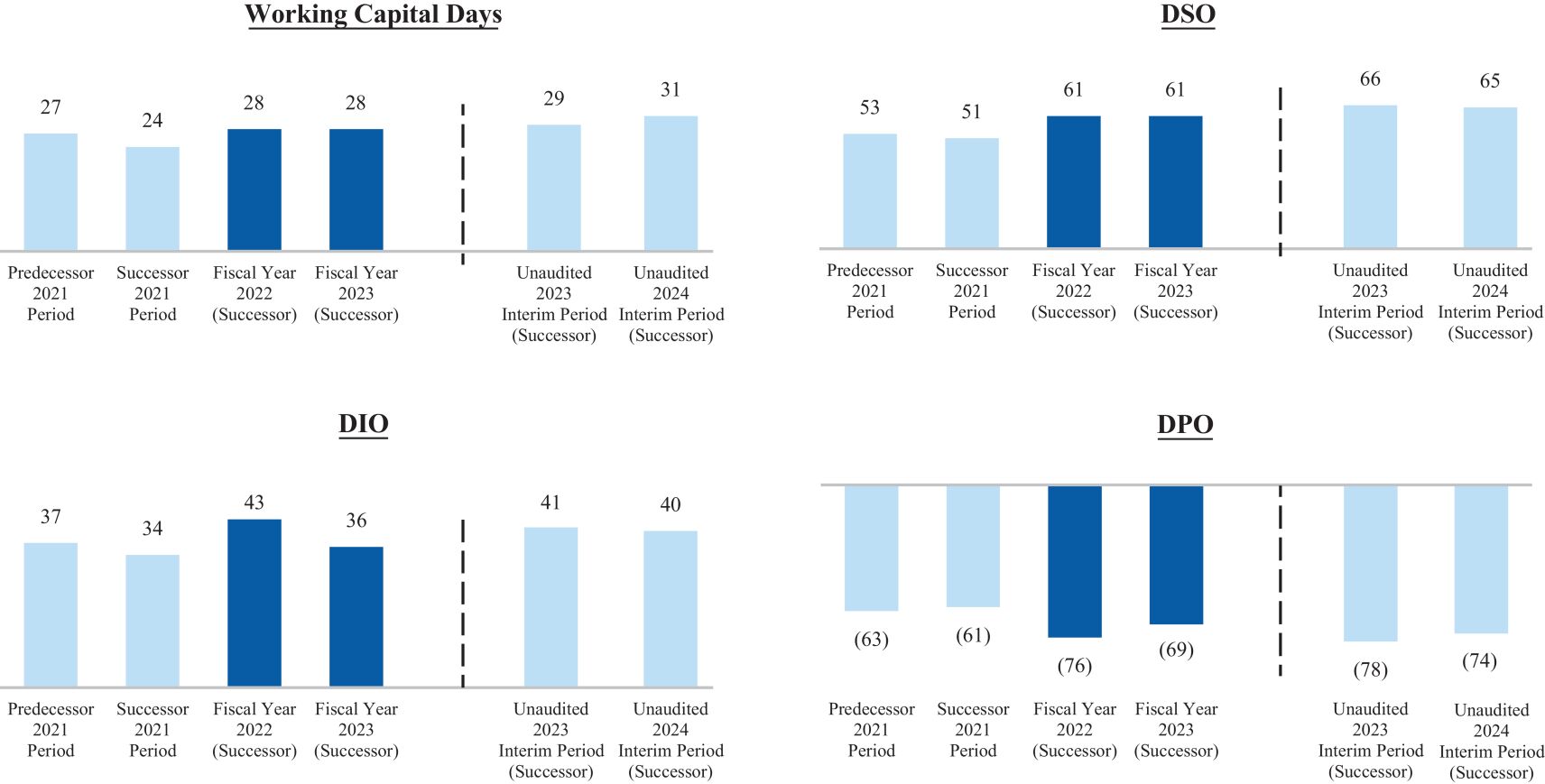

Presentation of Financial Information

Ingram Micro Holding Corporation conducts its operations through its subsidiaries, including its indirect subsidiary Ingram Micro Inc., a Delaware corporation and operating company which is doing business as and which we refer to as Ingram Micro. As used in this prospectus, unless the context otherwise indicates, any reference to our Company, the Company, us, we and our refers, prior to the Imola Mergers, to our predecessor, Ingram Micro, together with its consolidated subsidiaries, and after the Imola Mergers, to our successor, Ingram Micro Holding Corporation, together with its consolidated subsidiaries. Our Fiscal Year is a 52- or 53-week period ending on the Saturday nearest to December 31. All references herein to Fiscal Year 2020 (Predecessor), Fiscal Year 2022 (Successor) and Fiscal Year 2023 (Successor) represent the Fiscal Years ended January 2, 2021 (53 weeks), December 31, 2022 (52 weeks) and December 30, 2023 (52 weeks), respectively. All references herein to the Unaudited 2023 Interim Period (Successor) and Unaudited 2024 Interim Period (Successor) represent the twenty-six weeks ended July 1, 2023 (Successor) and June 29, 2024 (Successor), respectively.

As used in this prospectus, Platinum means Platinum Equity, LLC together with its affiliated investment vehicles.

Platinum formed Ingram Micro Holding Corporation (formerly known as Imola Holding Corporation) on September 28, 2020, and on December 9, 2020, Imola Acquisition Corporation, an investment vehicle of certain private investment funds sponsored and ultimately controlled by Platinum, Tianjin Tianhai Logistics Investment Management Co., Ltd., HNA Technology Co., Ltd. (HNA Tech), a part of HNA Group, GCL Investment Management, Inc., Ingram Micro and Imola Merger Corporation (Escrow Issuer) entered into an agreement pursuant to which Platinum indirectly acquired (through Imola Acquisition Corporation) Ingram Micro from affiliates of HNA Tech, for aggregate cash consideration of approximately $7.2 billion, net of any indebtedness acquired (the Acquisition Agreement). The acquisition closed on July 2, 2021 (the Acquisition Closing Date). To fund a portion of the consideration for the acquisition, Platinum contributed certain amounts in cash to an indirect parent of Ingram Micro in exchange for the issuance to Platinum of equity in such parent entity in connection with the acquisition (the Equity Contribution). Concurrently with the Equity Contribution and to finance the remaining portion of the consideration for the acquisition, Ingram Micro entered into the following:

| | the ABL Credit Facilities, consisting of a $500 million ABL Term Loan Facility and a $3,500 million ABL Revolving Credit Facility; |

| | the $2,000 million Term Loan Credit Facility; and |

| | the $2,000 million 2029 Notes. |

In connection with the acquisition, Ingram Micro repaid in full, or satisfied and discharged in full, the obligations under any governing instruments, as applicable, of the then existing indebtedness of the Company and its subsidiaries, except for certain additional lines of credit, short-term overdraft facilities and other credit facilities with approximately $179.4 million outstanding as of June 29, 2024, and entered into the agreements governing its current indebtedness as described above (the Financing Transactions). See Description of Material Indebtedness.

As part of the acquisition, Imola Merger Corporation merged with and into GCL Investment Management Inc., an affiliate of HNA Tech, which immediately thereafter merged with and into GCL Investment Holdings,

iii

Table of Contents

Inc., which subsequently and immediately then merged with and into Ingram Micro, with Ingram Micro as the surviving entity (collectively, and together with the closing of the transactions contemplated by the Acquisition Agreement, the Equity Contribution and the Financing Transactions related to the acquisition, the Imola Mergers).

For the purpose of discussing our financial results, (i) we refer to ourselves (Ingram Micro Holding Corporation) as the Successor in the periods following the Imola Mergers and the Predecessor (Ingram Micro Inc.) during the periods preceding the Imola Mergers and (ii) we refer to the period from January 3, 2021 to July 2, 2021 as the Predecessor 2021 Period and the period from July 3, 2021 to January 1, 2022 as the Successor 2021 Period. The financial information of the Company has been separated by a vertical line on the face of the consolidated financial statements to distinguish the Successor and Predecessor periods. See Note 1, Organization and Basis of Presentation, to our audited consolidated financial statements.

The Companys consolidated financial data for the Predecessor 2021 Period, the Successor 2021 Period, as of January 1, 2022 (Successor), the respective periods as of and for the Fiscal Years ended December 31, 2022 (Fiscal Year 2022 (Successor)) and December 30, 2023 (Fiscal Year 2023 (Successor)) have been derived from our audited consolidated financial statements, which are included elsewhere in this prospectus.

To facilitate comparability of Fiscal Year 2022 (Successor) and Fiscal Year 2023 (Successor) to the fiscal year ended January 1, 2022, this prospectus also includes unaudited pro forma condensed combined financial information for key financial metrics and results of operations for the year ended January 1, 2022 (the Unaudited Pro Forma 2021 Combined Period), which gives effect to the Imola Mergers, on a pro forma basis, as if they had occurred on January 3, 2021. See Unaudited Pro Forma Condensed Combined Statement of Income.

Numerical figures included in this prospectus and the consolidated financial statements included in this prospectus are presented in U.S. dollars rounded to the nearest million, unless otherwise noted. Certain amounts presented in tables are subject to rounding adjustments and, as a result, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

Unless indicated otherwise, the information included in this prospectus assumes that (i) the shares of Common Stock to be sold in this offering are sold at $21.50 per share, which is the midpoint of the estimated offering range set forth on the cover page of this prospectus and (ii) all shares offered by us and the selling stockholder in this offering are sold (other than pursuant to the underwriters option to purchase additional shares as described herein).

Non-GAAP Financial Measures

Our financial statements included in this prospectus have been prepared in accordance with accounting principles generally accepted in the United States (GAAP). We have included certain non-GAAP financial measures in this prospectus, as further described below, that may not be directly comparable to other similarly titled measures used by other companies and therefore may not be comparable among companies. For purposes of Regulation G under the Exchange Act (Regulation G) and Section 10(e) of Regulation S-K under the Securities Act (Regulation S-K), a non-GAAP financial measure is a numerical measure of a companys historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statements of operations, balance sheets, or statement of cash flows of the company; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from most directly comparable measure so calculated and presented. Pursuant to the requirements of Regulation G, we have provided reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures. These non-GAAP measures are provided because our management uses these financial measures in monitoring and evaluating our ongoing results and trends.

iv

Table of Contents

This prospectus contains non-GAAP financial measures, including EBITDA, Adjusted EBITDA, Adjusted Income from Operations, Adjusted Income from Operations Margin, Adjusted Free Cash Flow, Non-GAAP Net Income and Adjusted Return on Invested Capital, which are financial measures that are not required by, or presented in accordance with GAAP.

We believe that, in addition to our results determined in accordance with GAAP, EBITDA, Adjusted EBITDA, Adjusted Income from Operations, Adjusted Income from Operations Margin, Adjusted Free Cash Flow, Non-GAAP Net Income and Adjusted Return on Invested Capital are useful in evaluating our business and the underlying trends that are affecting our performance. The non-GAAP measures noted above are primary indicators that our management uses internally to conduct and measure its business and evaluate the performance of its consolidated operations. Our management believes these non-GAAP financial measures are useful as they provide meaningful comparisons to prior periods and an alternate view of the impact of acquired businesses. These non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP. These non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting our business. A material limitation associated with these non-GAAP measures as compared to the GAAP measures is that they may not be comparable to other companies with similarly titled items that present related measures differently. The non-GAAP measures should be considered as a supplement to, and not as a substitute for or superior to, the corresponding measures calculated in accordance with GAAP. See Summary Historical and Unaudited Pro Forma Condensed Combined Financial and Other Data for a reconciliation to the most directly comparable financial measure stated in accordance with GAAP.

Offering Reorganization Transactions

Historically, we have had two classes of common stock, Class A voting common stock and Class B non-voting common stock. Our Second Amended and Restated Certificate of Incorporation, referred to herein as our amended and restated certificate of incorporation, which will be effective after the effectiveness of this registration statement, but prior to the consummation of this offering, will convert our Class A voting common stock and Class B non-voting common stock into Common Stock on a 1-for-1 basis and effect a 8,367.19365-for-1 stock split with respect to our Common Stock. We refer to the effectiveness of our amended and restated certificate of incorporation, stock conversion and stock split as the Offering Reorganization Transactions.

v

Table of Contents

Certain Definitions

The following terms are used in this prospectus unless otherwise noted or indicated by the context:

| | 2029 Notes means the Companys $2,000 million aggregate principal amount 4.750% notes due 2029; |

| | ABL Credit Agreement means the credit agreement that governs the ABL Revolving Credit Facility and the ABL Term Loan Facility, dated as of July 2, 2021 by and among Imola Acquisition Corporation, Ingram Micro Inc., the borrowers therein, various lenders and issuing banks, and JP Morgan Chase Bank, N.A., as amended by Amendment No. 1 to the ABL Credit Agreement, dated as of August 12, 2021, as further amended by Amendment No. 2 to the ABL Credit Agreement, dated as of May 30, 2023, as further amended by Amendment No. 3 to the ABL Credit Agreement, dated as of June 17, 2024, and as further amended by Amendment No. 4 to the ABL Credit Agreement, dated as of September 20, 2024; |

| | ABL Credit Facilities means the ABL Term Loan Facility together with the ABL Revolving Credit Facility; |

| | ABL Revolving Credit Facility means the senior secured asset-based credit facility entered into on July 2, 2021, consisting of a multi-currency revolving credit facility (available for loans and letters of credit) in an aggregate principal amount of up to $3,500 million, subject to borrowing base capacity; |

| | ABL Term Loan Facility means the term loan facility in an aggregate principal amount of $500 million, entered into on July 2, 2021; |

| | Artificial Intelligence or AI refers to an engineered or machine-based tool or system that can, for a given set of objectives, generate outputs such as predictions, recommendations, or decisions influencing real or virtual environments; |

| | Asia-Pacific refers to the Asia-Pacific region; |

| | Credit Agreements means the Term Loan Credit Agreement together with the ABL Credit Agreement; |

| | Credit Facilities means the ABL Revolving Credit Facility together with the ABL Term Loan Facility and the Term Loan Credit Facility; |

| | EMEA refers, collectively, to the Europe, Middle East and Africa region; |

| | Indenture means the indenture that governs the 2029 Notes, dated as of April 22, 2021, by and between Imola Merger Corporation and the Bank of New York Mellon Trust Company, N.A., as trustee and notes collateral agent, as supplemented by that certain supplemental indenture, by and among Ingram Micro Inc., as issuer, the Guarantors (as defined therein) party thereto from time to time, and the Bank of New York Mellon Trust Company, N.A., as trustee and notes collateral agent; |

| | Latin America refers to the Latin American region; |

| | Machine Learning or ML refers to a branch of AI that focuses on the development of systems capable of learning from data to perform a task without being explicitly programmed to perform that task. Learning refers to the process of optimizing model parameters through computational techniques such that the models behavior is optimized for the training task; |

| | North America refers to the North America region encompassing the United States and Canada; |

| | Platinum means Platinum Equity, LLC together with its affiliated investment vehicles; |

| | Platinum Advisors means Platinum Equity Advisors, LLC, an entity affiliated with Platinum; |

vi

Table of Contents

| | Term Loan Credit Agreement means the term loan credit agreement that governs the Term Loan Credit Facility, dated as of July 2, 2021, by and among Imola Acquisition Corporation, Ingram Micro Inc., JP Morgan Chase Bank, N.A., and the lenders, agents and other parties thereto, as amended by Amendment No. 1 to the Term Loan Credit Agreement, dated as of June 23, 2023, as further amended by Amendment No. 2 to the Term Loan Credit Agreement, dated as of September 27, 2023, and as further amended by Amendment No. 3 to the Term Loan Credit Agreement, dated as of September 20, 2024; and |

| | Term Loan Credit Facility means the senior secured term loan facility pursuant to the Term Loan Credit Agreement. |

vii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all the information that you should consider before investing in shares of our Common Stock, and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, including Risk Factors, Cautionary Note Regarding Forward-Looking Statements, and our financial statements and the related notes included elsewhere in this prospectus, before deciding to purchase shares of our Common Stock. Unless the context indicates otherwise, references to our Company, the Company, us, we and our refers, prior to the Imola Mergers, to our predecessor, Ingram Micro, together with its consolidated subsidiaries, and after the Imola Mergers, to our successor, Ingram Micro Holding Corporation, together with its consolidated subsidiaries. Following this offering, we will be a controlled company under the NYSE corporate governance standards, and as a result, will rely on exemptions from certain corporate governance requirements. See Risk Factors.

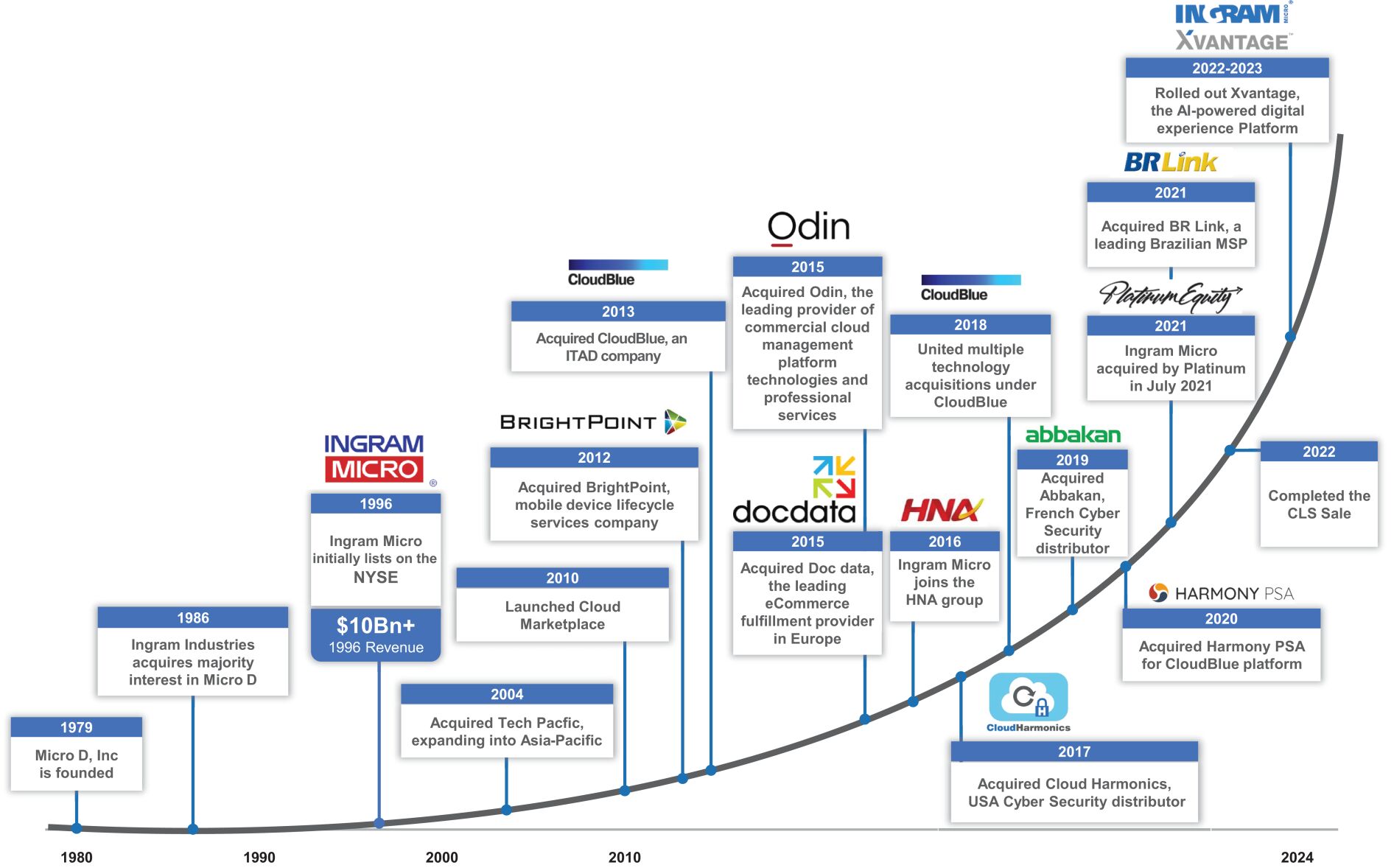

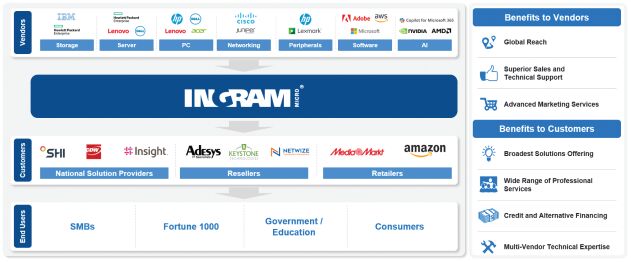

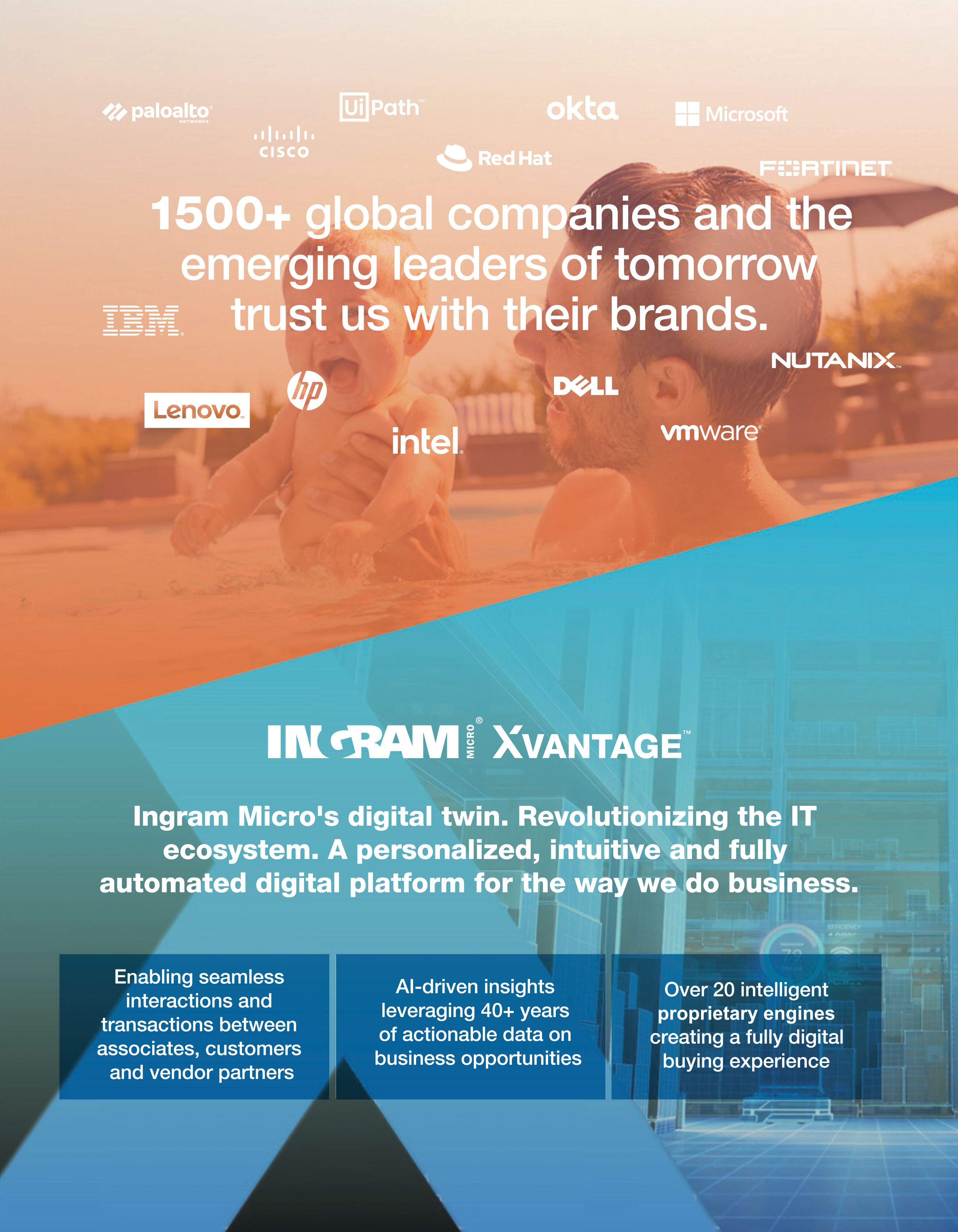

Ingram Micro is a leading solutions provider by revenue for the global information technology (IT) ecosystem helping power the worlds leading technology brands. With our vast infrastructure and focus on client and endpoint solutions (formerly referred to as commercial & consumer, as described elsewhere in this prospectus), advanced solutions offerings and cloud-based solutions, we enable our business partners to scale and operate more efficiently in the markets they serve. We deliver customized solutions to our vendor, reseller and retailer partners, enabling them to provide excellent business outcomes to the companies and consumers they serve. Through our global reach and broad portfolio of products, professional services offerings, software, cloud and digital solutions, we remove complexity and maximize the value of the technology products our partners make, sell or use, providing the world more ways to realize the promise of technology. In the face of significant economic uncertainty and volatility in commercial markets globally, we believe that our business remains well-positioned to benefit from technology megatrends, including cloud migration, enhanced security, Internet-of-Things (IoT), hybrid work and 5G.

As one of the worlds largest technology distributors by revenue and/or by global footprint, we have positioned Ingram Micro as an integral link in the global technology value chain, providing technology solutions and services from more than 1,500 vendor partners to a broad array of customers. With operations in 57 countries and 134 logistics and service centers worldwide, we serve as a solutions aggregator that we believe based on our experience in the industry enables us, together with our vendor partners, to reach nearly 90% of the global population with technology. Original Equipment Manufacturers (OEMs) and software providers rely on us to simplify global sales channels, gain operational efficiencies and address complex technology deployments. Our highly diversified base of more than 161,000 customers includes value-added resellers, system integrators, telecommunications companies and managed service providers. We provide our customers with broad product availability, technical expertise and a full suite of professional services to simplify their deployment and maximize their use of technology, including data-driven business and market insights, pre-sales engineering, post-sales integration, technical support and financing solutions. We manage more than 850 million units of technology products across more than 220,000 unique SKUs every year and handle, on average, in excess of 12,000 technical engineering calls monthly. Additionally, we provide resellers, retailers and OEMs with our IT Asset Disposition (ITAD) and Reverse Logistics and Repairs services to advance environmental sustainability through responsibly collecting and beneficially repurposing e-waste through remanufacturing, recycling, refurbishing and reselling technology devices. For the Predecessor 2021 Period, Successor 2021 Period, the Unaudited Pro Forma 2021 Combined Period, Fiscal Year 2022 (Successor), Fiscal Year 2023 (Successor) and the Unaudited 2024 Interim Period (Successor), we generated net sales of $26,406.9 million, $28,048.7 million, $54,455.6 million, $50,824.5 million, $48,040.4 million and $22,876.4 million, respectively, and net income of $378.5 million, $96.7 million, $366.1 million, $2,394.5 million, $352.7 million and $104.1 million, respectively. In addition, during such periods we generated Adjusted EBITDA of $647.8 million for the Predecessor 2021 Period, $746.3 million for the Successor 2021 Period, $1,384.2 million for the Unaudited Pro Forma 2021

1

Table of Contents

Combined Period, $1,349.4 million for Fiscal Year 2022 (Successor), $1,353.1 million for Fiscal Year 2023 (Successor) and $569.0 million for the Unaudited 2024 Interim Period (Successor). See Managements Discussion and Analysis of Financial Condition and Results of OperationsNon-GAAP Financial Measures. As of June 29, 2024, we had approximately 24,150 full-time associates.

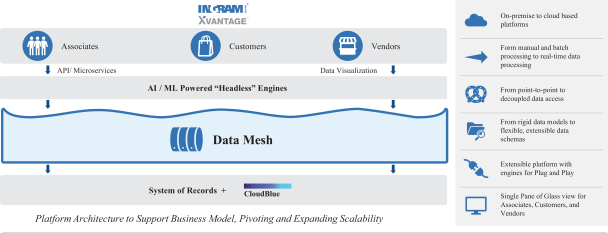

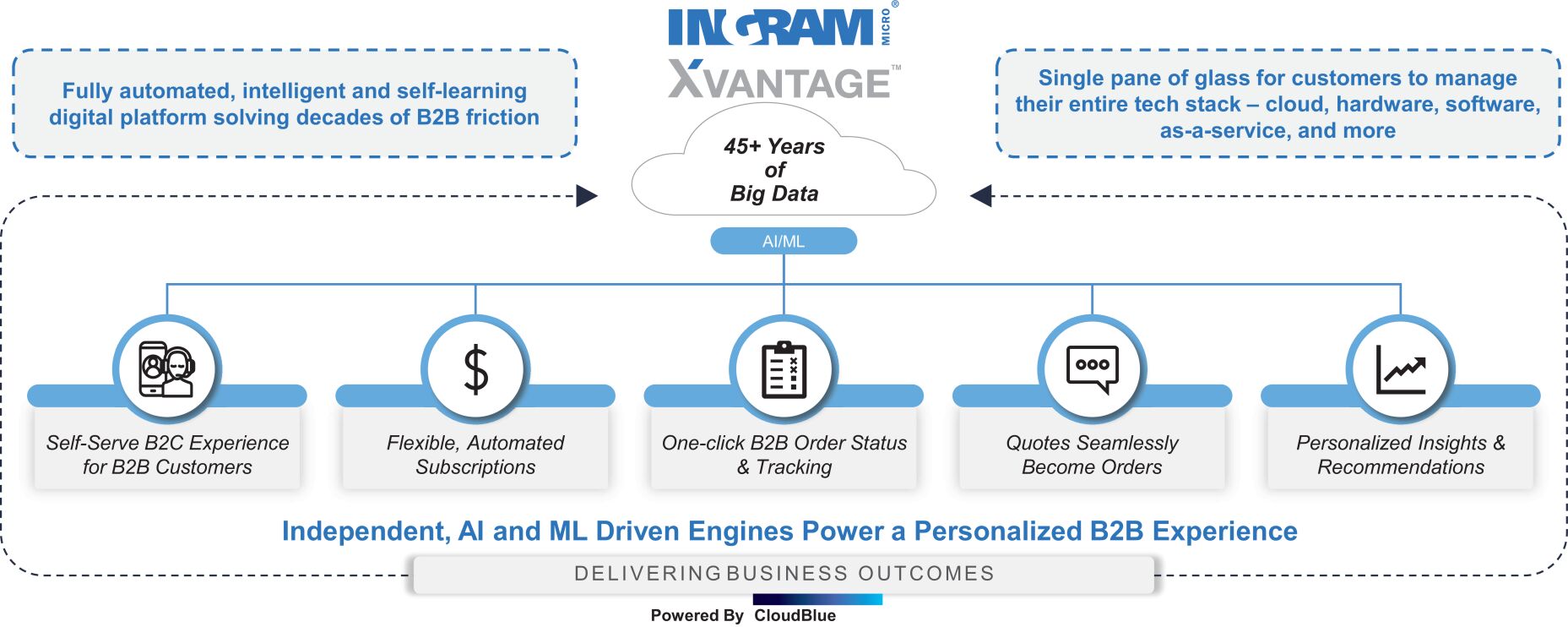

More than a decade ago, we embarked on a journey from being a traditional IT products distributor to creating an integrated marketplace for customized solutions. Since then, even in the midst of the recent global softening in demand for certain of our traditional offerings, including our client and endpoint solutions, we have invested more than $2 billion in technical resources, intellectual property, digital processes and systems, advanced solutions, specialty markets and professional services. From its inception, this organic evolution, aided by a number of key acquisitions, has focused on creating a one-stop-shop experience for our thousands of customers to seamlessly procure and manage a comprehensive suite of technology solutions and services. The anything-as-a-service (XaaS) market has now been a rapidly expanding market and a key growth driver for several years, leading to our accelerated development of highly integrated solutions, services and marketplaces. First launched in 2010, our cloud marketplace has been a transformative part of our journey, enabling leading software vendors to connect with thousands of customers, who in turn support millions of end users, in what we believe to be the worlds largest cloud ecosystem. Today, our cloud marketplace hosts more than 200 cloud solutions, aggregates 29 marketplaces and manages over 36 million seats for more than 33,000 customers. Building on our successful cloud marketplace, our proprietary CloudBlue digital commerce platform, and other acquired and organically developed intellectual property, in 2022 we launched Ingram Micro Xvantage, our fully automated, self-learning and innovative digital platform, which is now live in key countries around the globe. We believe that our customers will increasingly experience a single pane of glass through which we offer a full menu of IT devices, software solutions, cloud-based subscriptions, and technology services across hundreds of vendors and brands as we migrate our cloud marketplace and other marketplaces to Ingram Micro Xvantage and continuously integrate additional capabilities to the platform. Through Ingram Micro Xvantage, many tasks that previously took hours or even days, such as order status updates, price quotes and vendor catalog management activities, can now be accomplished by the platform in a few minutes, driving significant efficiency gains for our vendors, customers and associates. We believe that we offer our third-party partners the industrys first comprehensive and streamlined distribution experience in a single integrated digital platform. Harnessing the insights gained from hundreds of millions of transactions over the past decade, Ingram Micro Xvantage is a significant milestone in our evolution benefiting from many years of investment and IT distribution experience. As our dynamic business model continues to evolve and we continue our transition to becoming more of a platform company, we will be better able to adapt to customer demands in the constantly shifting IT landscape.

Our focus on successful business outcomes for our partners and their clients, together with the investments described above, have enabled us to deliver solid financial results and expand our advanced solutions and cloud businesses even in the midst of the recent global softening in demand for certain of our traditional offerings, including our client and endpoint solutions.

Advanced Solutions generated net sales of $7,329 million for the Predecessor 2021 Period, $8,309 million for the Successor 2021 Period, $17,354 million for Fiscal Year 2022 (Successor), $17,883.3 million for Fiscal Year 2023 (Successor) and $8,164.9 million for the Unaudited 2024 Interim Period (Successor). Cloud generated net sales of $125.9 million for the Predecessor 2021 Period, $161.7 million for the Successor 2021 Period, $326.0 million for Fiscal Year 2022 (Successor), $383.3 million for Fiscal Year 2023 (Successor) and $226.1 million for the Unaudited 2024 Interim Period (Successor).

2

Table of Contents

Industry Background

We believe that technological innovationas a primary catalyst of growth, differentiation and efficiency gains across industries and applicationswill continue to drive long-term expansion in the global IT market, even as certain technologies and sectors experience declines in demand from time to time. As the world becomes increasingly digital, connected and automated, companies and consumers will need to invest in the latest technology and security around these solutions to effectively interact with key stakeholders, grow their business and drive operational efficiencies.

We believe our industry will benefit from a number of key trends:

| | Continued cloud growth and shift to a subscription-and consumption-based economy. Enterprises and individuals continue to increase their adoption of XaaS solutions, and the shift to cloud alternatives is driving continued infrastructure buildout globally. The ability to bill, provision, launch, price, recognize revenue and manage subscriptions is becoming increasingly essential to successful business outcomes and continued growth. |

| | Need for enhanced security. The information security market has been impacted by an increase in the number and the complexity of threats and targeted attacks over the past several years. Given the impact that attacks have had on organizations across the world, security will remain a top priority for senior management teams and boards of directors, driving continued spend on security in the future. According to IDC, global security spend is expected to grow to $329 billion in 2027, an 11.4% compound annual growth rate (CAGR) from 2023. |

| | Exponential increase in the number of connected devices and the complexity of technology solutions. According to IDC, there will be approximately 46 billion connected IoT devices by 2025, generating approximately 67 zettabytes of data. As the lines between devices, software, and services become increasingly blurred due to ubiquitous connectivity and the rise of sophisticated edge computing and distributed networks, among other drivers, the ability to deliver integrated solutions is critical to capture market opportunities. The number of worldwide NPU-equipped AI PC shipments is expected to grow to 167 million shipments by 2027, a 58.4% CAGR from 2023. We expect these market dynamics to increase demand for devices with faster processing, reduced latency, enhanced security and better overall performance, which are all factors that also speed refresh and upgrade cycles across multiple forms of technology. |

| | The rise of artificial intelligence. We believe AI will benefit our industry in two primary ways. First, for those distributors who are able to successfully execute the necessary shift to a digital platform, we expect AI to remove friction in the ordering process, improving and personalizing the customer experience by leveraging predictive models to generate insights and recommendations, and to power real-time dynamic pricing engines, accelerating the sales cycle and bolstering productivity. Second, AI will increasingly drive a shift in the design and application of all types of technology, which is expected to drive accelerated demand for PCs, datacenter equipment, AI-enabled software, and many other applications. |

| | Rollout of broadband and 5G networks will continue to drive technology growth. High-speed mobile networks are the backbone of the modern technology ecosystem and necessary to each of the aforementioned trends. We believe companies and consumers in both emerging and mature markets will need to continue investment in IT hardware, software, and services to capitalize on the expanding set of opportunities enabled by universal connectivity. |

Distributors provide vendors a highly attractive variable cost channel to customers, including consultative sales and engineering support, as well as trade credit, financing, marketing and logistics services. Vendors leverage distributors capabilities to aggregate demand and provide extensive market reach and coverage across

3

Table of Contents

different geographies, while simplifying supply chain and go-to-market complexity. Distributors provide customers, including resellers and end users, with critical product information and availability, aggregate multi-vendor technical expertise and service offerings, train and enable new certified sellers and authorized partners, extend financial solutions and trade credit and provide efficient supply chain logistics and technical support globally. As a result of these strategic benefits, we believe the opportunity for growth in the technology distribution industry will continue to exceed that of the global technology market as both hardware and software vendors increasingly rely on distributors to support their go-to-market strategies.

As technology solutions have become more complex, reliance on distributors to provide product, marketing, technical and financial support has increased. Increasingly, distributors play a central integrating role in the technology ecosystema distributor is no longer merely a link in the chain between vendors and resellers within the traditional two-tier distribution model, but today acts as the connective tissue among hardware and software vendors, service providers, resellers, integrators, marketplaces, and end customers. Companies are increasingly seeking perspectives on the most efficient ways to design, procure and optimize their technical infrastructures, and customers increasingly demand high-quality service and support including advanced technical, training, support and financing services. These strategic engagements are bringing the technology value chain closer to the end customer and will increasingly require a comprehensive platform to serve customer needs.

Additionally, environmental concerns and regulatory requirements for the disposal of IT products and data security regulations, such as general data protection regulation (GDPR), create challenges for companies in managing the safe disposal of IT products, limiting the risk of data loss and reducing or eliminating subsequent financial losses. In addition to the environmental considerations, improperly deleting data and disposing of hardware can result in costly management of data and potential exposures if data is not managed properly and securely.

Our Market Opportunity

Numerous trends continue to reshape the way organizations go to market, driving increasingly complex supply chains in industries ranging from enterprise hardware and software to mobility and retail. Despite recent fluctuations in businesses and consumers purchasing behaviors, particularly for discrete products, demand remains strong for end-to-end technology solutions, cloud-centric business applications and subscription management services. Additionally, there is an increasing need to simplify and automate the delivery of complicated virtual, physical and hybrid solutions and replace what currently are complex, fragmented, people-dependent processes and systems used to consume technology.

As a key partner to OEMs, software providers and businesses, our objective is to:

| 1. | Provide the industrys most efficient and reliable route to market, with comprehensive capabilities to enhance the value of the solutions we deliver to drive successful business outcomes; |

| 2. | Enable and increase our partners success, breadth and reach as the market evolves to additional cloud-centric and digital solutions, driven by our proprietary digital platform, Ingram Micro Xvantage, and the marketplaces and engines that are increasingly being integrated into it; |

| 3. | Digitize the supply and value chains and influence the way technology is acquired and demand is generated for technology solutions and services to enable our partners to transact via a fully digital platform to make business decisions, build demand and develop new offerings based on intelligent data insights; and |

| 4. | Sustainably support the circular economy and lifecycle of technology by helping organizations quickly cycle through IT assets in a secure and environmentally friendly manner, providing IT asset disposition and reverse logistics and repair offerings to reduce e-waste. |

4

Table of Contents

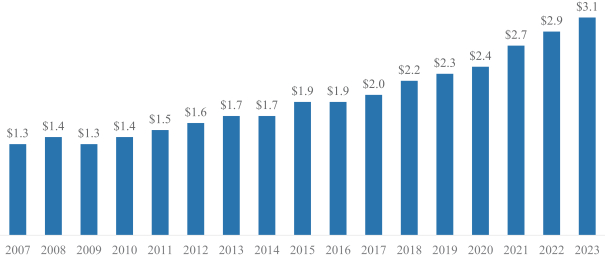

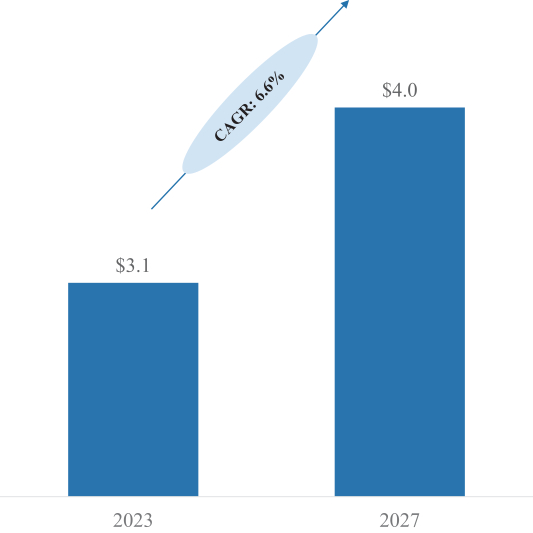

According to IDC, global IT spend across hardware, software and IT services was $3.1 trillion (excluding infrastructure-as-a-service) in 2023, and is expected to grow to $4.0 trillion in 2027, a 6.6% CAGR. We believe the proportion of the IT market sold through distribution has increased over the last decade, and we expect distribution to remain the principal route to market for most technology vendors. As technology becomes more complex, drawing off of multiple vendors and providers, and continues to be consumed on premises, virtually and in hybrid manners, we believe the importance of distribution will continue even as more technology becomes cloud-based. We continue to offer a significant value proposition for both vendors and customers by bringing these diverse and numerous technologies together in one source.

Today, a number of key technology categories such as cybersecurity, data center, sustainability and cloud are driving strong growth in technology spend. According to IDC, global security spend is expected to grow to $329 billion in 2027, an 11.4% CAGR from 2023. As IT spend continues to increase, we expect demand for IT asset disposition and reverse logistics and repair services to also increase. According to Technavio, the total addressable market for IT asset disposition is expected to reach $31.6 billion in 2027, up from $20.6 billion in 2023, a 11.3% CAGR. According to Statista, the total addressable market for reverse logistics and repair services in 2027 is expected to reach $861 billion, up from $700 billion in 2023, a 5.3% CAGR. We believe our differentiated capabilities enable us to continue our leadership position in this large and growing market.

Cloud adoption is accelerating, with public/dedicated cloud as a service spend expected to reach $1.4 trillion by 2027, up from $693 billion in 2023, a 19.6% CAGR, according to IDC. Cloud marketplaces have become increasingly important to software, hardware and infrastructure vendors go-to-market strategy, providing a unique value proposition to vendors including market reach, reduced complexity for customers and the ability to bundle services and broader solutions from multiple sources. According to IDC, the global digital transformation market, including hardware, software and IT and business services, is estimated to grow from $2.2 trillion in 2023 to $3.9 trillion in 2027, a 15.9% four-year CAGR. We believe our broad product offering, extensive vendor ecosystem and diversified customer base, combined with our highly scalable automated platform, position us to capture a greater share in a rapidly growing market. As more software licenses currently sold directly to end users move to a cloud as a service model, we expect our Serviceable Addressable Market in cloud offerings to grow. Based on our experience in the industry, we believe the strength of our Ingram Micro Cloud Marketplace and CloudBlue platform allows us to capture cloud opportunities that may not be available to our competitors.

Key Benefits of Our Business Model

Our technology and cloud solutions business model is purpose-built for todays technology landscape and the technology ecosystem of the future. We serve as an integral link in the global technology value chain, driving sales, reach and profitability for vendors, value-added resellers, mobile network operators, service and solution providers and other customers. We have a strong presence in each of the four regions in which we operate: North America, EMEA, Asia-Pacific and Latin America. Across each of these markets, our partners trust us to deliver a full spectrum of hardware, software, cloud, managed and professional and other services.

Our business model provides the following key benefits:

| | Strong Market Access through Global Network of Partners and Customers. We are one of the global leaders in technology and cloud distribution with leading market share around the globe. We have more than 1,500 vendor partners. Furthermore, we have a highly diversified base of more than 161,000 customers serving the small and mid-sized business (SMB) market, which consists of millions of businesses, and more than 33,000 cloud marketplace customers, covering millions of end users and over 36 million seats. With operations on six continents, we believe based on our experience in the industry our geographic reach and presence are superior to that of our competitors. |

5

Table of Contents

| | Ingram Micro Xvantage Designed for the Evolution of XaaS. Initially introduced to the market in late 2022, our Ingram Micro Xvantage digital platform, including the AI and ML capabilities that are foundational to the platforms functionality, has already been launched in the United States, Germany, Canada, the United Kingdom, Mexico, Colombia, Austria, France, Italy, Belgium, the Netherlands, Spain, India and Australia. We expect to continue launching in additional geographies, providing a singular experience for our customers and partners to procure and consume technology. As we migrate our cloud marketplace into Ingram Micro Xvantage in more and more geographies, and as we integrate additional engines into the digital platform, we believe that our interactions and transactions will become increasingly seamless for customers and vendors, and will enable them to drive further growth with significant efficiencies. We expect the investment and commitment we continue to make in Ingram Micro Xvantage will further strengthen our existing relationships, attract new partners and customers and influence end user technology preferences. Xvantage continues to develop with close to two dozen patents pending, 29 million new lines of code, over a hundred internally developed AI models and over 20 proprietary engines powering and supporting the platforms functionality, enabling Xvantage to offer its users instant pricing, billing automation, marketing capabilities, hardware and cloud subscriptions, the ability to configure, quote and track each order, and various other insights and recommendations personalized to the user. |

| | Efficient Go-To-Market Channel through Demand Aggregation. We serve as a central, unified platform for our vendors to aggregate demand from large and highly fragmented markets, providing vendors with a highly attractive and efficient channel to market and a valuable extension of their sales forces. As some vendors adjust their cost structure and trim their workforces, we believe more business has shifted, and will continue to shift, to distribution channels. The SMB market sector, for example, includes a greater share of long-tail customers who are often more difficult for vendors to access efficiently and profitably given they have lower buying power than large customers who can consolidate orders. |

| | Broad Solutions Offering to Meet Evolving Customer Demand. The average Ingram Micro solution is composed of six different technologies, demonstrating the complexity in the way products and services are consumed in todays marketplace. Our long-standing, entrenched relationships with the largest global technology vendors allow us to provide customers with access to a deep portfolio of hundreds of thousands of technology and cloud products from vendors around the world. This, combined with our Ingram Micro Cloud Marketplace, connects partners with what we believe to be the worlds largest cloud ecosystem, enabling them to generate and satisfy demand more efficiently. Our cloud marketplace serves 29 aggregated marketplaces and supports more than 200 cloud solutions, a number that is rapidly increasing. |

| | Integrated Managed and Professional Services Tailored to Customer Needs. Customers increasingly demand integrated multi-vendor, high-quality service and support. As of June 29, 2024, we had approximately 1,060 engineers globally who provide the high-quality technical, training and pre- and post-sales support, integration and ongoing managed services our partners and customers need, without adding incremental overhead. These engineers collectively hold thousands of current technical certifications, with a single certification typically requiring an investment of 30 hours or more. Through a personalized and consultative approach, we tailor solution sets to specific customer needs and deploy certified technicians to assist where vendors have gaps and where our customers are unable to support the high cost of technical talent or implementing highly complex multi-vendor solutions. We also enable the circular economy by providing responsible collection and repurposing of e-waste through remanufacturing, recycling, refurbishing and reselling technology devices. We believe such efforts help our customers achieve their environmental sustainability goals by keeping harmful materials out of landfills. |

6

Table of Contents

Our Strategic Priorities

We are a technology-focused company and have invested heavily in developing and acquiring technology, including intellectual property, to enable our partners success. We expect our continued investment in robotics and automation, within our advanced logistics centers will augment our efficient, customer-centric delivery capabilities and that our continued investment in our digital capabilities, including in the integration of over 20 proprietary engines within Ingram Micro Xvantage, will enhance the experience of our customers and vendors. We have a proven track record of profitable growth which has enabled us to achieve a position of great competitive strength and remain focused on continuing to deliver strong future growth. We recognize the markets need for sophisticated IT solutions and our strategies are developed with this in mind. Our overall objective is to continue to expand our business and our profitability by delivering innovative and thoughtful solutions to enable business partners to scale and operate more efficiently and successfully in the markets they serve.

Our strategic priorities are aligned to achieve this objective and focus on:

| | Adding digital tools and services to deepen engagement with customers and vendors and continuing to develop a transformative, fully digital platform to further simplify, automate, digitize and scale the delivery of our products and solutions portfolio. We intend to continue expanding our digital and services capabilities to connect and team with our partners and customers and serve their evolving needs. Our goal is to have our entire portfolio of products, software and services available on Ingram Micro Xvantage, delivering a singular business-to-consumer-like experience to our vendor and customer partners in the business-to-business market to interact, learn, partner, plan and consume technology via seamless and autonomous engines. We believe Ingram Micro Xvantage has already influenced, and will continue to influence, the acquisition and delivery of the full spectrum of technology solutions and services. By digitizing and automating quote-to-order, order status and tracking, customer service and other critical business support services, we are reducing transactional complexity and inefficiencies inherent in more manual processes and tools. In addition, as our business intelligence grows through applying the latest in AI and ML technology, we are able to provide higher-value capabilities and recommendations to our customers, enabling them to expand their reach into new markets and categories in a growing XaaS economy. Ingram Micro Xvantage is designed to allow our customers to increasingly benefit from a business-to-consumer-like experience, enabling them to shift time and resources away from administering transactions and toward interacting with their end customers and providing them higher value. We expect the investment and commitment we continue to make in Ingram Micro Xvantage will further strengthen our existing relationships, attract new partners and customers and influence end user technology preferences. Xvantage continues to develop with close to two dozen patents pending, 29 million new lines of code, over a hundred internally developed AI models and over 20 proprietary engines powering and supporting the platforms functionality, enabling Xvantage to offer its users instant pricing, billing automation, marketing capabilities, hardware and cloud subscriptions, the ability to configure, quote and track each order, and various other insights and recommendations personalized to the user. |

| | Growing our emerging technologies practices, including cybersecurity and AI, and further extending our technology portfolio to build out additional higher value, more complex product and services offerings. One of our investment priorities for the foreseeable future will be continued expansion of our advanced and emerging technology offerings. We plan to further expand our ecosystem by identifying emerging technologies and higher value, more complex solutions, and adding additional technology vendors to our platform. |

| | Enhancing profitability through operational improvement initiatives, digitization and automation. We have additional opportunities to drive operational enhancement and efficiencies in areas such as pricing, management of rebates, mix enrichment, automation and warehouse efficiency, to name a few. We also plan to continue building our technology roadmap to further develop and enhance our customer and vendor interface and experience. |

7

Table of Contents

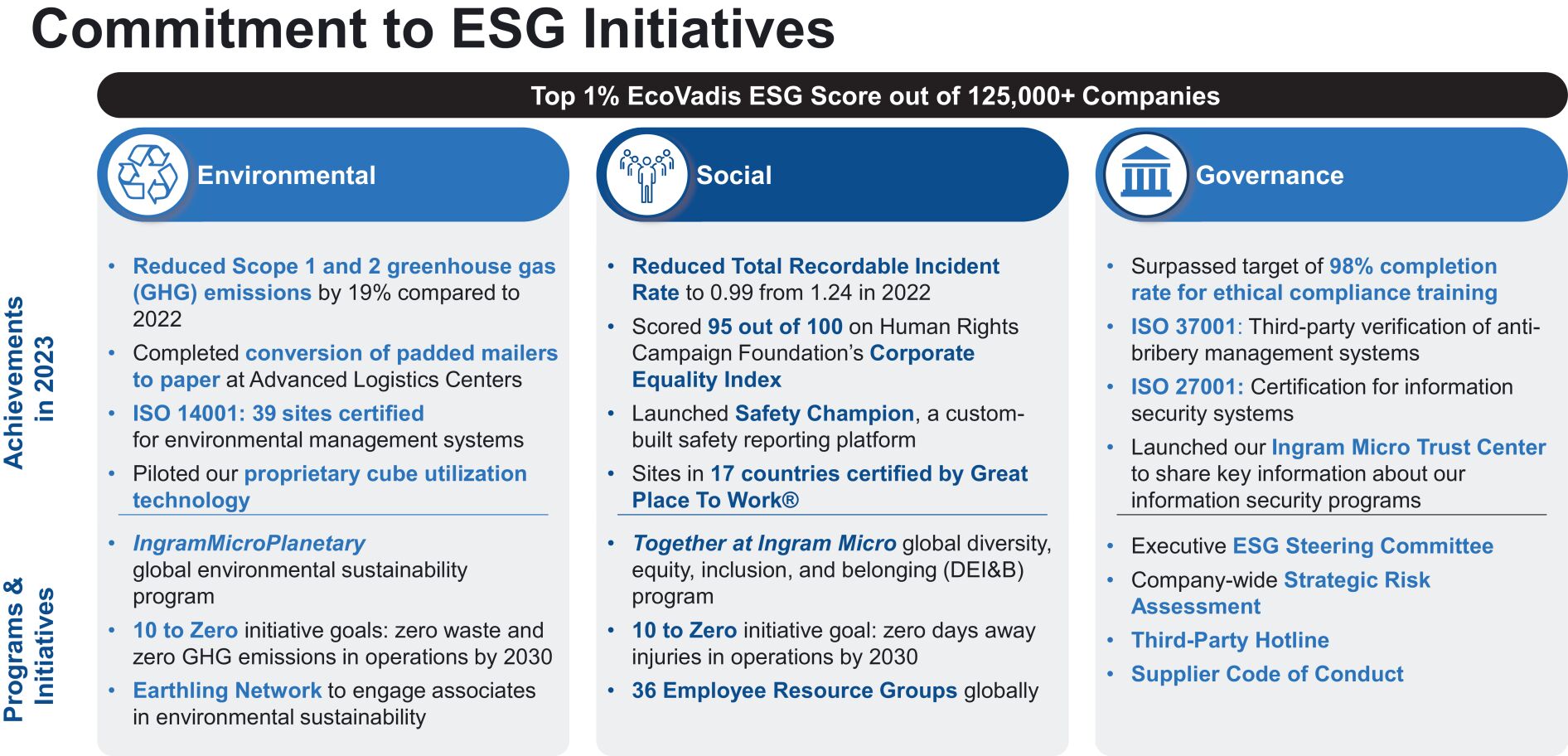

| | Continuing our commitment to Environmental, Social and Governance (ESG) initiatives. We will continue to focus on environmental stewardship, social responsibility and effective governance across our global operations. We aim to continue to invest in our communities and improve our environmental performance, while developing a comprehensive environmental sustainability data management system across our operations. We are committed to minimizing our environmental impact both directly through our operations and indirectly through our influence within our value chain. We will continue to invest in and evolve our ESG efforts, and over the next few years we expect to continue to focus on ESG competency and reporting with a continued focus on climate action and waste reduction, diversity, equity and inclusion (DE&I), supply chain risk assessments and alignment with UN Sustainable Development Goals relevant to our impacts and activities. |

Our Products and Solutions

We provide a broad line of technology, services and solutions from more than 1,500 vendor partners, enabling us to offer comprehensive solutions to our reseller and retail customers. Our suppliers are the worlds trusted technology leaders, along with emerging technology brands, and include the industrys premier computer hardware suppliers, mobility hardware suppliers, networking equipment suppliers, software publishers and other suppliers of computer peripherals, consumer electronics, cloud-based solutions, unified communication and collaboration, data capture-point of sale (DC / POS) and physical security products, such as Advanced Micro Devices, Apple, Cisco, Dell Technologies, Hewlett Packard Enterprise, HP Inc., Lenovo, Microsoft, NVIDIA and Super Micro Computer. Our cloud portfolio comprises third-party services and subscriptions spanning a breadth of products from solution software through infrastructure-as-a-service. Our Ingram Micro Cloud Marketplace service portfolio consists of third-party cloud-based services or subscription offerings sold through our own platform. Vendors on the platform include Adobe, Amazon Web Services, Cisco, Microsoft, Proofpoint and VMware.

Our cloud marketplace, which in certain key jurisdictions has already been integrated into one unified Ingram Micro Xvantage, connects partners with what we believe to be the worlds largest cloud ecosystem, enabling them to generate demand more efficiently and providing third-party cloud-based services and subscription offerings through a digital platform for the consumption of cloud solutions in an ever-increasing cloud-centric world. We support more than 200 cloud solutions and manage over 36 million seats through our cloud marketplace. Our CloudBlue platform also provides services to many of the worlds leading telecommunication companies, as well as to managed service providers, technology distributors and value-added resellers, and manages over 52 million seats. Our professional services offerings add value to our partners and customers by providing data-driven business and market insights, pre-sales engineering, post-sales integration, technical support and financing solutions to further grow their businesses. In addition, our ITAD and Reverse Logistics and Repairs businesses play an important role in advancing environmental sustainability and bridging the digital divide through electronic device reverse logistics, refurbishment, recycling, reuse and resale for organizations, including the worlds largest mobile telecom providers. By helping to enable a circular economy, we support our customers in achieving their sustainability goals and enable consumers to access quality, affordable smartphones, computers and other devices.

We are focused on building our presence in those product categories and services and solutions that will benefit from key growth trends, such as the continuing technology shift to cloud-centric solutions, hybrid data centers, anything-as-a-service offerings, AI, hyper automation and circular economy solutions.

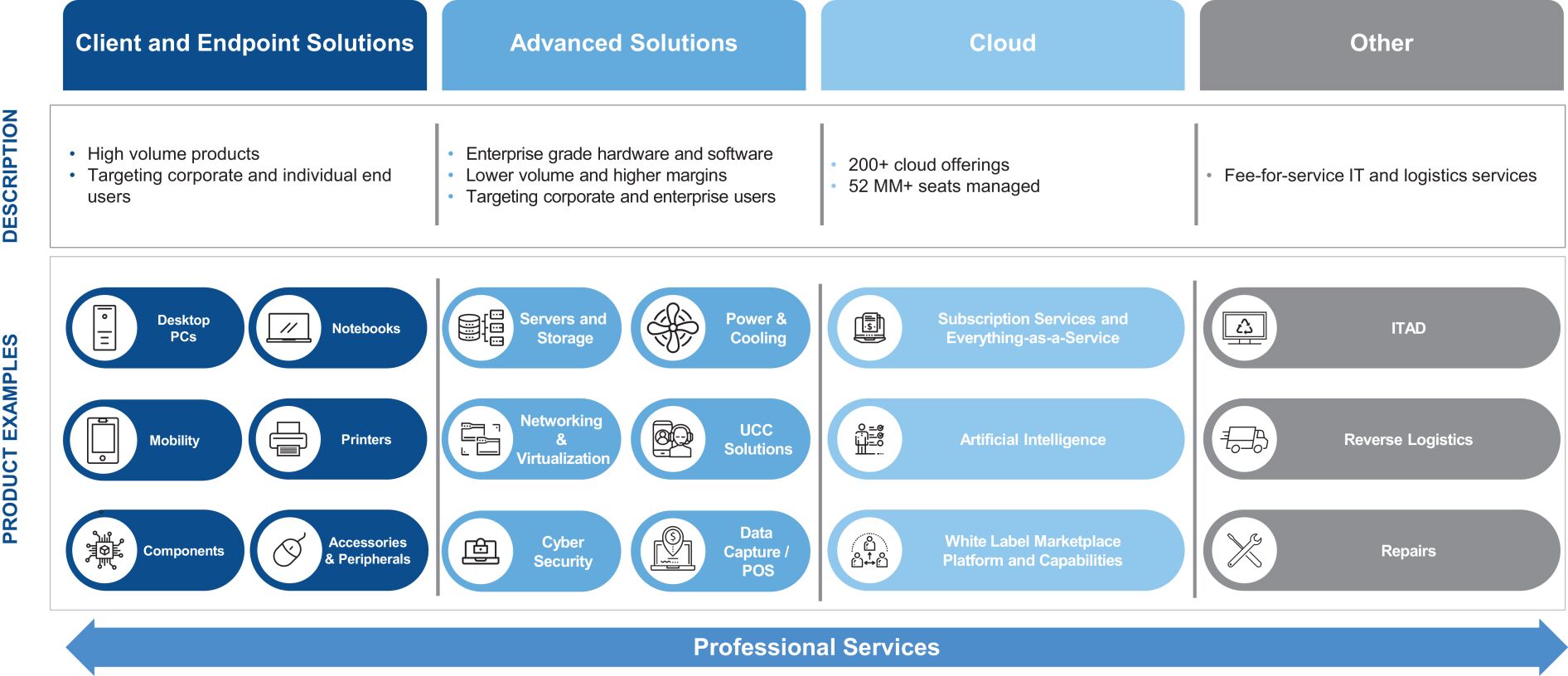

As part of our global presence in each of our four geographic regions, we offer customers a full spectrum of hardware and software, cloud services and logistics expertise through three main lines of business: Technology Solutions, Cloud and Other. In each of our geographic segments we offer customers the product categories listed below broken down under the respective line of business. Beginning in the second quarter of 2024, we began to refer to our Commercial & Consumer category as Client and Endpoint Solutions as a better reflection of the nature of the products and services within that category.

8

Table of Contents

Technology Solutions:

| | Client and Endpoint Solutions (formerly referred to as Commercial & Consumer). We offer a variety of higher-volume products targeted for corporate and individual end users, including desktop personal computers, notebooks, tablets, printers, components (including hard drives, motherboards, video cards, etc.), application software, peripherals, accessories and Ingram Micro branded solutions. We also offer a variety of products that enable mobile computing and productivity, including phones, phone tablets (including two-in-one notebook/tablet devices), smartphones, feature phones, mobile phone accessories, wearables and mobility software. |

| | Advanced Solutions. We offer enterprise grade hardware and software products aimed at corporate and enterprise users and generally characterized by specific projects, which account for lower volumes but higher gross margin. And while Advanced Solutions requires higher operational expenditures, primarily in the form of technical capabilities to serve the market, the operating margin delivered by this business is also generally stronger than Client and Endpoint Solutions. Within this product category, we offer servers, storage, networking, infrastructure hardware and software (covering system management, network and storage), hybrid and software-defined solutions, cybersecurity, power & cooling and virtualization (software and hardware) solutions. This category also includes training, professional services and financial solutions related to these product sets. We also offer customers DC / POS, physical security, audio visual & digital signage, Unified Communications and Collaboration (UCC) and Telephony, IoT (smart office/home automation) and AI products. |

Cloud:

| | Cloud-based Solutions. Our cloud portfolio comprises third-party services and subscriptions spanning a breadth of products from solution software through infrastructure-as-a-service. As technology consumption increasingly moves to XaaS, we have expanded our cloud solutions to more than 200 third-party cloud-based services or subscription offerings, including business applications, security, communications and collaboration, cloud enablement solutions and infrastructure-as-a-service. Also included here are the offerings of our CloudBlue business, which provides customers with multi-channel and multi-tier catalog management, subscription management, billing and orchestration capabilities through a software as a service (SaaS) model. |

Other:

| | Other offerings. We provide customers with ITAD, reverse logistics and repair and other related solutions, and prior to April 2022 included the operations sold through the CLS Sale further described herein. See CLS Sale. These offerings represent less than 10% of net sales for all periods presented herein. Products offered within our Reverse Logistics and Repairs solution includes returns management, repair and refurbishment and an aftermarket sales channel. |

Imola Mergers

Platinum formed Ingram Micro Holding Corporation (formerly known as Imola Holding Corporation) on September 28, 2020, and on December 9, 2020, Imola Acquisition Corporation, an investment vehicle of certain private investment funds sponsored and ultimately controlled by Platinum, Tianjin Tianhai Logistics Investment Management Co., Ltd., HNA Technology Co., Ltd. (HNA Tech), a part of HNA Group, GCL Investment Management, Inc., Ingram Micro, and Imola Merger Corporation (Escrow Issuer) entered into an agreement pursuant to which Platinum indirectly acquired (through Imola Acquisition Corporation) Ingram Micro from affiliates of HNA Tech, for aggregate cash consideration of approximately $7.2 billion, net of any indebtedness acquired (the Acquisition Agreement). Pursuant to the Acquisition Agreement, HNA Tech had the right to receive an amount not to exceed $325.0 million in the aggregate, on the achievement by the Company of certain adjusted EBITDA targets for fiscal years 2021, 2022 and 2023. Based upon adjusted EBITDA achieved through the end of the Successor 2021 Period, such payment of $325.0 million was earned in its entirety and was paid on April 11, 2022. See Note 1, Organization and Basis of Presentation, to our audited consolidated financial statements.

9

Table of Contents

The acquisition closed on July 2, 2021 (the Acquisition Closing Date). To fund a portion of the consideration for the acquisition, Platinum contributed certain amounts in cash to an indirect parent of Ingram Micro in exchange for the issuance to Platinum of equity in such parent entity in connection with the acquisition (the Equity Contribution). Concurrently with the Equity Contribution and to finance the remaining portion of the consideration for the acquisition, Ingram Micro entered into the following:

| | the ABL Credit Facilities, consisting of a $500 million ABL Term Loan Facility and a $3,500 million ABL Revolving Credit Facility; |

| | the $2,000 million Term Loan Credit Facility; and |

| | the $2,000 million 2029 Notes. |

In connection with the acquisition, Ingram Micro repaid in full, or satisfied and discharged in full, the obligations under any governing instruments, as applicable, of the then existing indebtedness of the Company and its subsidiaries, except for certain additional lines of credit, short-term overdraft facilities and other credit facilities with approximately $179.4 million outstanding as of June 29, 2024, and entered into the agreements governing its current indebtedness as described above (the Financing Transactions). See Description of Material Indebtedness.

As part of the acquisition, Imola Merger Corporation merged with and into GCL Investment Management Inc., an affiliate of HNA Tech, which immediately thereafter merged with and into GCL Investment Holdings, Inc., which subsequently and immediately then merged with and into Ingram Micro, with Ingram Micro as the surviving entity (collectively, and together with the closing of the transactions contemplated by the Acquisition Agreement, the Equity Contribution and the Financing Transactions related to the acquisition, the Imola Mergers).

10

Table of Contents

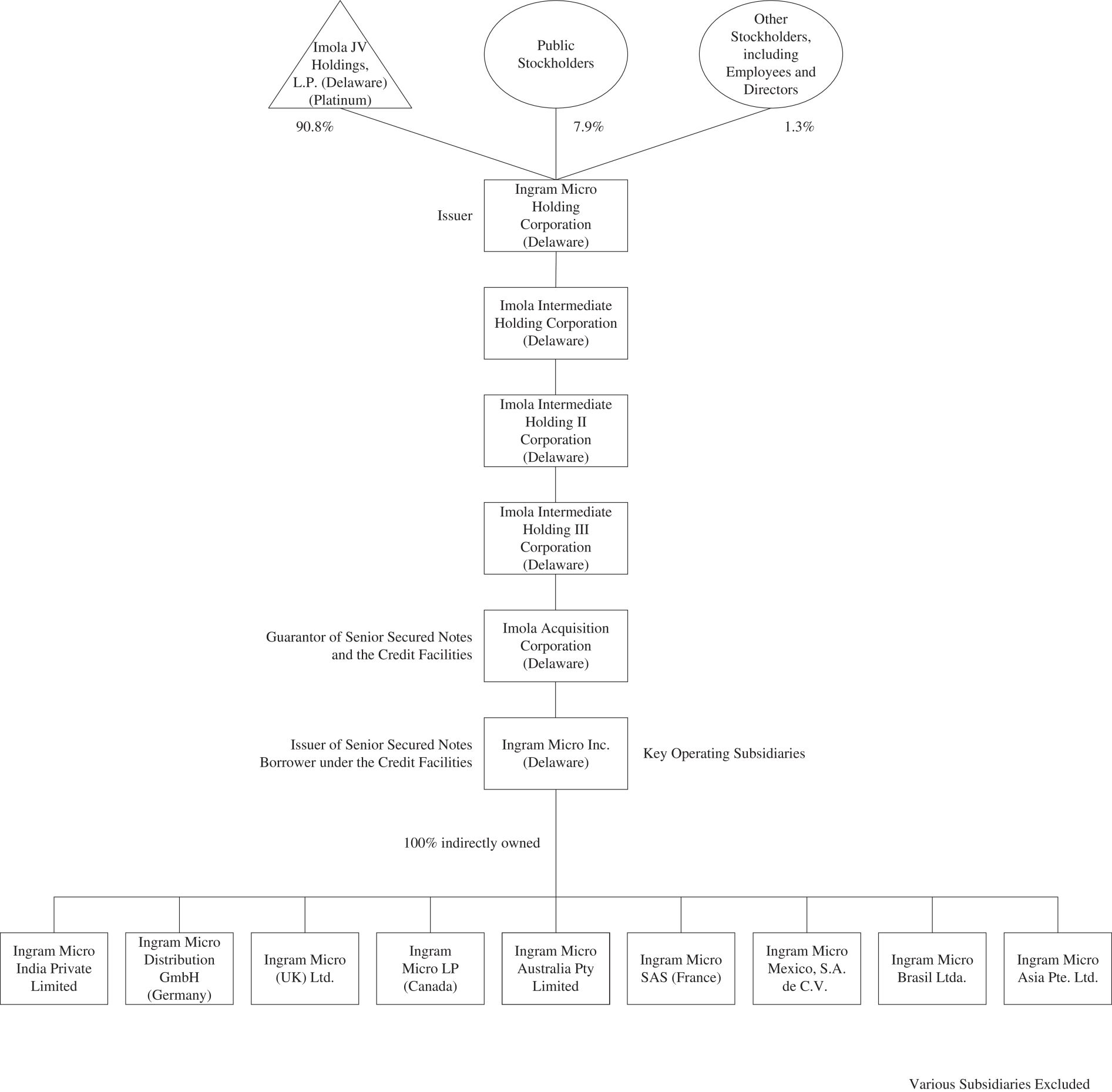

The diagram below depicts our simplified organizational structure following the Imola Mergers and the completion of this offering of our Common Stock, including the entities through which we predominantly conduct our Technology Solutions business in the countries indicated below. Such entities, which we consider to be our key operating subsidiaries, consist of Ingram Micro Inc. and certain indirectly wholly owned subsidiaries of Ingram Micro Inc., each of which is set forth below. This chart is provided for illustrative purposes only and does not purport to represent all legal entities owned or controlled by us.

CLS Sale

On December 8, 2021, we announced the sale of most of our Commerce and Lifecycle Services business, including Shipwire, our proprietary order management platform, and technology forward logistics and commerce

11

Table of Contents

businesses, with operations in North America, Europe, Latin America and Asia-Pacific, to the CMA CGM Group, a France-based provider of global shipping and logistics, in exchange for consideration of approximately $3.0 billion, subject to certain adjustments (the CLS Sale). Following the CLS Sale, we refer to such business, to the extent it remains, as Other. The transaction contemplated a primary closing date with respect to the vast majority of the operations that were the subject of the CLS Sale and successive deferred closings in respect of other operations. The primary closing of the transaction occurred on April 4, 2022 and the deferred closings were completed between the primary closing date of April 4, 2022 and November 16, 2022. In connection with the primary closing of the transaction on April 4, 2022, we entered into a transition services agreement (TSA) with CMA CGM Group, under which we are providing certain services, including logistical, IT and corporate services. The services provided under the TSA will terminate at various times but those that are not fully transitioned by the applicable specified time may be extended under certain circumstances to no later than 24 months from April 4, 2022, unless otherwise extended by mutual agreement. The majority of the human resources services that the Company was obligated to provide under the TSA were fully transitioned and completed at the end of December 2022. In addition, the majority of the operations and IT services were transitioned during 2023, and management expects the remaining services to be fully transitioned and completed by the end of 2024. See Note 1, Organization and Basis of Presentation, to our audited consolidated financial statements. On April 4, 2022, we used a portion of the proceeds received from the primary closing of the CLS Sale to pay down the balance then-outstanding under our $500 million ABL Term Loan Facility. The business encompassed in the CLS Sale had $781.0 million, $853.1 million and $399.2 million of net sales for the Predecessor 2021 Period, the Successor 2021 Period and Fiscal Year 2022 (Successor), respectively, and $42.2 million, $29.0 million and $3.7 million of income from operations for the Predecessor 2021 Period, the Successor 2021 Period and Fiscal Year 2022 (Successor), respectively.

Morgan Stanley Bank, N.A., an affiliate of Morgan Stanley & Co. LLC, JPMorgan Chase Bank, N.A., an affiliate of J.P. Morgan Securities LLC, Royal Bank of Canada, an affiliate of RBC Capital Markets, LLC, and Stifel Bank & Trust, an affiliate of Stifel, Nicolaus & Company, Incorporated, each an underwriter of this offering, are lenders, agents and joint lead arrangers and bookrunners under the ABL Term Loan Facility. As a result of the use of proceeds from the CLS Sale, such affiliates of the underwriters received a portion of the proceeds from the CLS Sale. See UnderwritingOther Relationships.

On April 29, 2022, the Company declared and paid a dividend to our current stockholders of approximately $1.75 billion with proceeds from the primary closing of the CLS Sale.

Recent Developments

Preliminary Estimated Operating Results for the Thirteen Weeks Ended September 28, 2024

Set forth below are preliminary unaudited estimates of certain financial information for the thirteen weeks ended September 28, 2024 and actual unaudited financial information for the thirteen weeks ended September 30, 2023. We have not yet finalized our financial information for the thirteen weeks ended September 28, 2024, and therefore the unaudited financial information for the thirteen weeks ended September 28, 2024 presented herein reflects preliminary estimates and assumptions based on currently available information and is subject to, among other things, completion of our financial closing procedures, which we do not expect to complete for the thirteen weeks ended September 28, 2024 until after the completion of this offering. As a result, while this information is presented with ranges that we consider to be reasonable, it remains in all cases subject to change pending finalization, and our actual results will not be available to you prior to investing in this offering. This financial information should not be viewed as a substitute for full quarterly financial statements prepared in accordance with GAAP. You should also note that additional information on results presented herein will be included in future reports expected to be available only after this offering, such as complete financial results for the thirteen weeks ended September 28, 2024 and September 30, 2023 and footnote disclosures associated with our financial results.

12

Table of Contents

These estimates should not be viewed as a substitute for our historical consolidated financial statements and the accompanying notes included elsewhere in this prospectus. These estimates may not be indicative of the results for any future period as a result of various factors, including, but not limited to, those discussed in the sections titled Risk Factors and Cautionary Note Regarding Forward-Looking Statements.

The preliminary financial data for the thirteen weeks ended September 28, 2024 included in this prospectus has been prepared by, and is the responsibility of, our management. PricewaterhouseCoopers LLP has not audited, reviewed, examined, compiled, nor applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto.

Following the information in the tables below is a discussion of Net Sales, Gross Profit and Income from Operations for the Thirteen Weeks ended September 28, 2024. The trends for this period are consistent with those discussed in Managements Discussion and Analysis of Financial Condition and Results of Operations. For additional information about our non-GAAP financial measures, see Summary Historical and Unaudited Pro Forma Condensed Combined Financial and Other DataNon-GAAP Financial Measures and Managements Discussion and Analysis of Financial Condition and Results of OperationsNon-GAAP Financial Measures.

| Thirteen Weeks Ended September 28, 2024 |

Thirteen Weeks Ended September 30, 2023 |

|||||||||||||||||||||||

| Low (estimate) | High (estimate) | Actual | ||||||||||||||||||||||

| ($ in thousands except share and per share data) |

Amount | % of Net Sales |

Amount | % of Net Sales |

Amount | % of Net Sales |

||||||||||||||||||

| Net Sales |

$ | 11,727,000 | $ | 11,750,000 | $ | 11,925,373 | ||||||||||||||||||

| Gross Profit |

843,000 | 7.19 | % | 845,000 | 7.19 | % | 854,844 | 7.17 | % | |||||||||||||||

| Income from Operations |

213,000 | 1.82 | % | 218,000 | 1.86 | % | 212,402 | 1.78 | % | |||||||||||||||

| Return on Invested Capital |

4.4 | % | 4.7 | % | 5.5 | % | ||||||||||||||||||

| Net Income |

73,000 | 0.62 | % | 77,000 | 0.66 | % | 86,783 | 0.73 | % | |||||||||||||||

| Basic and Diluted Earnings Per Share (1) |

2,746 | 2,896 | 3,265 | |||||||||||||||||||||

| Adjusted Income from Operations (2) |

249,000 | 2.12 | % | 254,000 | 2.16 | % | 265,481 | 2.23 | % | |||||||||||||||

| Adjusted EBITDA (3) |

328,000 | 2.80 | % | 332,000 | 2.83 | % | 313,971 | 2.63 | % | |||||||||||||||

| Adjusted Return on Invested Capital (4) |

11.0 | % | 11.3 | % | 12.4 | % | ||||||||||||||||||

| Non-GAAP Net Income (5) |

155,000 | 1.32 | % | 159,000 | 1.35 | % | 148,611 | 1.25 | % | |||||||||||||||

(1) Basic and Diluted Earnings Per Share figures presented in this table do not take into account the Offering Reorganization Transactions, which includes the effectiveness of our amended and restated certificate of incorporation, stock conversion and a 8,367.19365-for-1 stock split, which will occur after the effectiveness of this registration statement, but prior to the consummation of this offering.

| (2) | Adjusted Income from Operations: |