10-K: Annual report [Section 13 and 15(d), not S-K Item 405]

Published on March 5, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-K

____________________________________

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 28 , 2024

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ________ to ________

Commission file number 001-42384

____________________________________

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

||||||||||

|

|

|||||||||||

(Address of Principal Executive Offices) |

(Zip Code) |

||||||||||

(714 ) 566-1000

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o | |||||||||||

| x | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

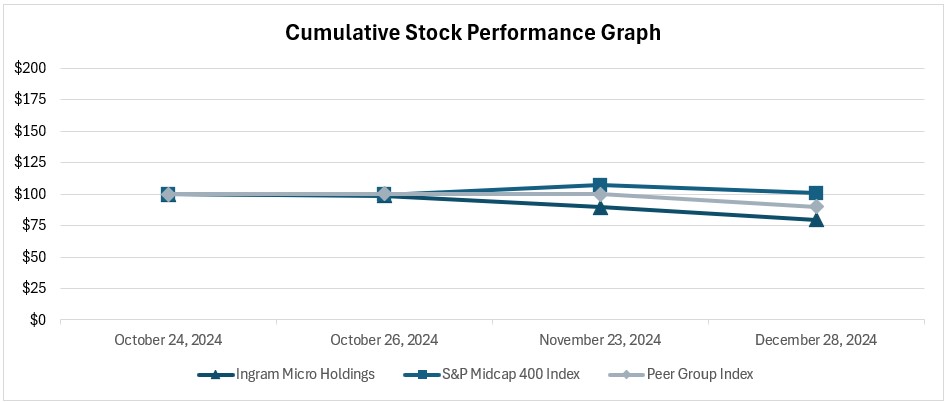

The registrant was not a public company as of June 29, 2024, the last business day of its most recently computed second fiscal quarter, and therefore cannot calculate the aggregate market value of the voting and non-voting common equity held by non-affiliates as of such date. The registrant’s common stock began trading on the New York Stock Exchange on October 24, 2024.

Number of shares of registrant’s common shares outstanding as of February 25, 2025 was 234,825,581 .

DOCUMENTS INCORPORATED BY REFERENCE

.

Table of Contents

| Page | ||||||||

2

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements may contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “estimates,” or “anticipates,” or similar expressions which concern our strategy, plans, projections or intentions, but such words are not the exclusive means of identifying forward-looking statements in this report. These forward-looking statements are included throughout this Annual Report on Form 10-K, including in the sections entitled “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and relate to matters such as our industry, growth strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. By their nature, forward-looking statements: speak only as of the date they are made; are not statements of historical fact or guarantees of future performance; and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws.

There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. Such risks, uncertainties and other important factors include, among others, the risks, uncertainties and factors set forth below under the heading “Risk Factors” included in this Annual Report on Form 10-K and the following:

•general economic conditions;

•our estimates of the size of the markets for our products and services;

•our ability to identify and integrate acquisitions and technologies into our platform;

•our plans to continue to expand;

•the provision of transition services to the buyer in the sale of a substantial portion of our Commerce & Lifecycle Services business (“CLS Sale”) and our ability to adjust our cost base as those transition service agreements expire;

•our ability to continue to successfully develop and deploy Ingram Micro Xvantage;

•the effect of the COVID-19 pandemic on our business;

•our ability to retain and recruit key personnel;

•the competition our products and services face and our ability to adapt to industry changes, including supply constraints for many categories of technology;

•current and potential litigation involving us;

•the global nature of our business, including the various laws and regulations applicable to us;

•the effect of various political, geopolitical and economic issues, including tariffs, and our ability to comply with laws and regulations we are subject to, both in the United States and internationally;

•our financing efforts;

•our relationships with our customers, OEMs and suppliers;

•our ability to maintain and protect our intellectual property;

•the performance and security of our services, including information processing and cybersecurity provided by third parties;

•our ownership structure;

•our dependence upon Ingram Micro Inc. and its controlled subsidiaries for our results of operations, cash flows and distributions; and

•our status as a “controlled company” and the extent to which the interests of Platinum Equity, LLC together with its affiliated investment vehicles (“Platinum”) conflict with our interests or the interests of our stockholders.

3

Part I

Item 1. Business

Overview

Ingram Micro is a leading solutions provider by revenue and/or by global footprint for the global information technology (“IT”) ecosystem helping power the world’s leading technology brands. With our vast infrastructure and focus on client and endpoint solutions, advanced solutions offerings, cloud-based and other solutions, we enable our business partners to scale and operate more efficiently in the markets they serve. We are at the center of the technology ecosystem and deliver customized solutions to our vendor and reseller partners, enabling them to provide excellent business outcomes to the end-user companies and consumers we serve. Through our global reach, our industry-leading business-to-business (“B2B”) platform, and our broad portfolio of products, professional services offerings and software, cloud and digital solutions, we remove complexity and maximize the value of the technology products our partners make, sell or use, providing the world more ways to realize the promise of technology. In the face of significant economic uncertainty and volatility in commercial markets globally, our business remains well-positioned to benefit from technology megatrends, including cloud migration, enhanced security needs, Internet-of-Things (“IoT”), hybrid work, artificial intelligence (“AI”), machine learning (“ML”), and 5G. Our business is organized into four reportable segments based on the different geographic regions in which we operate: North America; Europe, Middle East and Africa (“EMEA”); Asia-Pacific; and Latin America.

In October 2024 we completed an initial public offering (“IPO”), in which we issued and sold 11,600,000 shares of our Common Stock, and Imola JV Holdings, L.P. agreed to offer and sold 7,000,000 shares of their Common Stock at a public offering price of $22.00 per share. The underwriters were granted a 30-day option to purchase up to an additional 2,790,000 shares of Common Stock from Imola JV Holdings, L.P., the selling stockholder, which was exercised in full and closed on November 4, 2024.

Our Fiscal Year is a 52- or 53-week period ending on the Saturday nearest to December 31. All references herein to “Fiscal Year 2024”, “Fiscal Year 2023”, and “Fiscal Year 2022” represent the fiscal years ended December 28, 2024 (52 weeks), December 30, 2023 (52 weeks) and December 31, 2022 (52 weeks), respectively.

Our Strategic Priorities

We are a technology-focused company and have invested heavily in developing and acquiring technology, including intellectual property, to enable our partners’ success. We expect our continued investment in robotics and automation within our advanced logistics centers will augment our efficient, customer-centric delivery capabilities and that our continued investment in our digital capabilities, including in the integration of more than 20 proprietary AI-driven engines within Ingram Micro Xvantage, will enhance the experience of our customers and vendors. We have a proven track record of profitable growth which has enabled us to achieve a position of great competitive strength and remain focused on continuing to deliver strong future growth. We recognize the market’s need for sophisticated IT solutions and our strategies are developed with this in mind. Our overall objective is to continue to expand our business and our profitability by delivering innovative and thoughtful solutions to enable business partners to scale and operate more efficiently and successfully in the markets they serve.

Our strategic priorities are aligned to achieve this objective and focus on:

•Adding digital tools and services to deepen engagement with customers and vendors and continuing to develop a transformative, fully digital platform to further simplify, automate, digitize and scale the delivery of our products and solutions portfolio. Through our Xvantage platform, we deliver a singular business-to-consumer-like experience to our vendor and customer partners in the B2B market to interact, learn, partner, plan and consume technology via seamless and autonomous engines.

•Growing our emerging technologies practices, including cybersecurity and AI, and further extending our technology portfolio to build out additional higher value, more complex product and services offerings.

•Enhancing profitability through operational improvement initiatives, digitization and automation.

5

Our Products and Solutions

We provide a broad line of technology, services and solutions from more than 1,500 vendor partners, enabling us to offer comprehensive solutions to our reseller customers. Our suppliers are the world’s most trusted technology leaders, along with emerging technology brands, which include the industry’s premier computer hardware suppliers, mobility hardware suppliers, networking equipment suppliers and software publishers such as Advanced Micro Devices, Apple, Cisco, Dell Technologies, Hewlett Packard Enterprise, HP Inc., Lenovo, Microsoft, NVIDIA and Super Micro Computer.

We also work with suppliers of computer peripherals, consumer electronics, cloud-based solutions, unified communication and collaboration, data capture/point-of-sale (“DC / POS”) and physical security products. Our cloud portfolio comprises third-party services and subscriptions spanning a breadth of products from solution software to infrastructure-as-a-service. Our Ingram Micro Cloud Marketplace service portfolio consists of third-party cloud-based services or subscription offerings sold through our own platform. Vendors on the platform include Adobe, Amazon Web Services, Cisco, Microsoft, and Proofpoint. We sell products purchased from many vendors, but generated approximately 19%, 16% and 15% of our consolidated net sales in Fiscal Year 2024, Fiscal Year 2023 and Fiscal Year 2022, respectively, from products purchased from Apple Inc. Additionally, we generated approximately 10% of our consolidated net sales in Fiscal Year 2024, Fiscal Year 2023 and Fiscal Year 2022, from products purchased from HP Inc.

Our cloud marketplace, which in certain key jurisdictions has already been integrated into one unified Ingram Micro Xvantage platform, connects partners with what we believe to be the world’s largest cloud ecosystem, enabling them to generate demand more efficiently and provide third-party cloud-based services and subscription offerings through a digital platform for the consumption of cloud solutions in an ever-increasing cloud-centric world. We support more than 200 cloud solutions and manage over 36 million seats through our cloud marketplace. Our CloudBlue platform also provides services to many of the world’s leading telecommunication companies, as well as to managed service providers, technology distributors and value-added resellers, and manages over 52 million seats. Our professional services offerings add value to our partners and customers by providing data-driven business and market insights, pre-sales engineering, post-sale integration, technical support, trade credit, and financing solutions to further grow their businesses. In addition, our IT Asset Disposition (“ITAD”) and Reverse Logistics and Repairs businesses play an important role in advancing environmental sustainability and bridging the digital divide through electronic device reverse logistics, refurbishment, recycling, reuse and resale for organizations, including the world’s largest mobile telecommunication providers. By helping to enable a circular economy, we help our customers in achieving their sustainability goals and enable consumers to access high-quality, affordable smartphones, computers and other devices.

We categorize our product and service offerings into the following categories, each of which is offered in each of our four geographic segments:

Technology Solutions:

•Client and Endpoint Solutions. We offer a variety of higher-volume products targeted for corporate and individual end users, including desktop personal computers, notebooks, tablets, printers, components (including hard drives, motherboards, video cards, etc.), application software, peripherals, and accessories. We also offer a variety of products that enable mobile computing and productivity, including phones, phone tablets (including two-in-one “notebook/tablet” devices), smartphones, feature phones, mobile phone accessories, wearables and mobility software.

•Advanced Solutions. We offer enterprise-grade hardware and software products aimed at corporate and enterprise users and generally characterized by specific projects, which account for lower volumes than Client and Endpoint Solutions but higher-margin products individually and collectively in the form of solutions and related services. And while Advanced Solutions requires higher operational expenditures, primarily in the form of technical capabilities to serve the market, the operating margin delivered by this business is also generally stronger than Client and Endpoint Solutions. Within this product category, we offer servers, storage, networking, hybrid and software-defined solutions, cyber security, power and cooling and virtualization (software and hardware) solutions. This category also includes training, professional services and financing solutions related to these product sets. We also offer customers DC / POS, physical security, audio visual & digital signage, Unified Communications and Collaboration (“UCC”) and Telephony, IoT (smart office/home automation) and AI products.

6

Cloud:

•Comprised of Cloud-based Solutions, including third-party services and subscriptions spanning a breadth of products from solution software through infrastructure-as-a-service. As technology consumption increasingly moves to anything-as-a-service, we have expanded our cloud solutions to more than 200 third-party cloud-based services or subscription offerings, including business applications, security, communications and collaboration, cloud enablement solutions and infrastructure-as-a-service. Also included here are the offerings of our CloudBlue business, which provides customers with multichannel and multi-tier catalog management, subscription management, billing and orchestration capabilities through a software-as-a-service model.

Other:

•We provide customers with ITAD, reverse logistics and repair and other related solutions. These offerings represent less than 5% of net sales for all periods presented herein.

Our Customers

We distribute IT and mobility solutions to more than 161,000 reseller customers, including most of the leading resellers of IT products and services around the world and with many of the world’s leading mobility companies. We serve a customer base that includes value-added resellers, corporate resellers, retailers, custom installers, systems integrators, mobile network operators, mobile virtual network operators, direct marketers, internet-based resellers, independent dealers, product category specialists, reseller purchasing associations, managed service providers, cloud services providers, PC assemblers, independent agents and dealers, IT and mobile device manufacturers and other distributors. Many of our customers are heavily dependent on partners with the necessary systems, capital, inventory availability, logistics capabilities and distribution and repair facilities in place to provide fulfillment and other services. We benefit from a broad geographic presence in 57 countries that in turn can service more than 90% of the world’s population across more than 200 countries globally and are trusted by many of the world’s leading telecommunications companies, mobile operators and retail and consumer brands. We aim to reduce our exposure to the impact of business fluctuations by maintaining a balance in the customer categories we serve. No single customer accounted for more than 10% of our total net sales in any of the periods presented herein.

Sales & Marketing

Our global, customer-facing sales and marketing team, enabled by our Xvantage platform, drives our go-to-market model centered on a deep understanding of our customer needs, and a goal to provide the industry’s broadest solutions offering to meet evolving customer demand and increasing technology complexity. We have operations in 57 countries, spanning all global regions, while also serving many additional geographies through various export sales offices, including general telesales operations into numerous markets. Our sales teams work closely with our marketing organization to actively pursue leads generated from marketing programs and guide prospective customers through the sales process.

Our marketing effort is focused on generating awareness of Ingram Micro’s solutions offering, creating sales leads, establishing and promoting our brand and our vendor partners’ products. Additionally, we offer a wide range of training, professional services, education and support offerings to enable our customers to rapidly onboard, adopt and ultimately realize value from our solutions.

Our sales and marketing organization includes sales development, sales operations, field sales and marketing personnel. As of December 28, 2024, we had approximately 10,200 associates in our sales and marketing organizations spanning all global regions.

International Operations

Approximately 66%, 64% and 62% of our consolidated net sales for Fiscal Year 2024, Fiscal Year 2023 and Fiscal Year 2022, respectively, were generated by our international operations. As our international operations constitute a significant portion of our consolidated net sales, they are subject to fluctuations in the U.S. dollar against foreign currencies.

7

Seasonality

We experience some seasonal fluctuations in demand in our business. For instance, we typically see lower demand, particularly in Europe, during the summer months. Additionally, we also experience an increase in demand in the fourth quarter, driven primarily by typical enterprise budgeting cycles across our geographies and business categories and the pre-holiday stocking and associated higher logistics-based fulfillment fees, which tends to have greater seasonal impact on our Client and Endpoint Solutions and Other categories. These seasonal fluctuations have historically impacted our revenue and working capital including receivables, payables and inventory. Our extensive experience combined with a flexible workforce allows us to modulate our operations and workforce demand fluctuations throughout the year.

Competition

We operate in a competitive environment globally. Competition in our business is based primarily on factors such as level of service, products and solutions breadth and availability, subscription management capabilities, credit terms and availability, price, financing solutions, speed of delivery, effectiveness of sales and marketing programs, real-time analytic offerings and e-commerce tools. We compete with other high-volume and value-added international distributors, as well as numerous other smaller, specialized local and regional competitors who generally focus on narrower markets, products, or particular sectors. We also face competition from our vendors that sell directly to resellers, retailers and end-users. Our top competitors include global companies such as TD Synnex, Arrow Electronics, Inc., Scansource, Inc., Westcon-Comstor, Synnex Technology International and Anixter International, and local and regional distributors such as Also Holding, Esprinet, Redington, Exclusive Networks, Intcomex, D&H, Carahsoft, AppDirect and Pax8, along with a number of other smaller local distributors. We believe that we are well-equipped to outperform our competitors in all areas due to our comprehensive product and service offerings, broad global reach, highly skilled workforce and global distribution network.

Government Regulation

We are subject to a number of U.S. federal, U.S. state and foreign laws and regulations, covering tax, environmental (relating to product stewardship, including the European Union Waste Electrical and Electronic Equipment Directive), labor and employment, workplace safety advertising, intellectual property, federal securities, trade protection, anti-money-laundering, anti-corruption and anti-bribery, anti-competition, antitrust, internet and e-commerce, network security, encryption, payments and consumer protection relating to the promotion and sale of merchandise and the operation of fulfillment centers. The products we sell may be subject to tariffs, treaties and various trade agreements, as well as foreign and domestic laws and regulations affecting the import and export of IT products. For more information on the risks associated with complying with applicable laws, please see “Risk Factors—Risks Related to the Macroeconomic and Regulatory Environment—We operate a global business that exposes us to risks associated with conducting business in multiple jurisdictions” and “Risk Factors—Risks Related to the Macroeconomic and Regulatory Environment—Our failure to comply with the requirements of environmental, health and safety regulations or other laws and regulations applicable to a distributor of consumer products could adversely affect our business.”

We are also subject to data privacy, data security and data protection laws and regulations that impose restrictions on the collection, processing and use of personal data in the jurisdictions in which we operate. For instance, we are subject to the California Consumer Privacy Act and other U.S. state comprehensive privacy laws; the General Data Protection Regulation (“GDPR”) and European Economic Area (“EEA”) member state implementing laws, including as retained in UK law; other similar laws in Brazil and elsewhere; restrictions related to e-marketing, including the ePrivacy Directive in the EEA and the Privacy and Electronic Communications Regulation in the UK; and data localization requirements in China and Russia. The legal and regulatory environment in this space is constantly developing, with an expanding number of jurisdictions considering or enacting new privacy or data security laws, which may not correspond with previously enacted requirements. Ensuring our ongoing compliance with any new requirements may generate additional or unanticipated costs, or otherwise impact our financial condition. For more information on risks related to the development of these laws, see “Risk Factors—Risks Related to Information Technology, Data Privacy and Intellectual Property—Changes in the regulatory environment regarding privacy and data protection regulations could have a material adverse effect on our results of operations.”

We monitor changes in the laws and regulations to which we are subject. Our legal and compliance team and our information security team oversee our data protection strategy and monitor our compliance with laws and regulations generally. These teams manage, implement and oversee internal privacy policies and security measures, including regular monitoring and testing of systems and equipment.

8

We believe that we are in material compliance with applicable laws and regulations, and we are not aware of any laws or regulations that are likely to materially impact our net sales, cash flow or competitive positions or result in any material expenditures. However, many of the laws and regulations to which we are subject continue to develop and could be interpreted, applied or amended in ways that are unfavorable to our business.

Our Trademarks and Service Marks

We own or license various trademarks and service marks, including, among others, “Ingram Micro,” the Ingram Micro logo, “CloudBlue,” “Aptec,” “Xvantage” and “Trust X Alliance.” Certain of these marks are registered, or are in the process of being registered, in the United States and various other countries. Even though our marks are not registered in every country where we conduct business, in many cases we have acquired rights in those marks because of our continued use of them.

Human Capital Resources

As of December 28, 2024, we had approximately 23,500 full-time associates. Additionally, as of December 28, 2024 we utilized the services of approximately 5,250 full-time equivalent temporary or contract workers at peak, who provide us with the workforce agility we require. Works councils or unions represent some of our associates in certain countries, almost exclusively where required by local regulations or brought in through acquisitions; our U.S. associates are not represented by a labor union, nor are they covered by a collective bargaining agreement.

Ethical Conduct

We believe our culture of ethics and integrity is built on a foundation of strong corporate governance, encapsulated in our Code of Conduct. Fair business practices are fundamental to our ability to establish trust with our partners, our associates and the communities in which we operate as well as maintain our reputation. Our ethical compliance program, which is overseen by the audit committee of our board of directors, covers areas such as anti-corruption, anti-bribery, anti-money laundering and harassment and whistleblower compliance. The program spans all our entities, across all operating regions and markets in which we have a presence. We are also a member of the Global Technology Distribution Council, which comprises the technology industry’s top wholesale distributors who drive more than $150 billion in annual worldwide sales, allowing us to participate in the development of an industry approach to address corruption.

Total Rewards

We believe people should be paid for what they do and how they do it, regardless of their personal characteristics. To deliver on that commitment, we benchmark and set pay ranges based on market data and consider factors such as an associate’s role and experience, the location of their job and their performance. We also review our compensation practices, both in terms of our overall workforce and individual associates, to ensure our pay is fair and equitable. We have reviewed the compensation of associates to ensure consistent pay practices by conducting annual rewards equity reviews.

We offer total rewards that are market-competitive and performance-based, driving innovation and operational excellence. Our compensation programs, practices and policies reflect our commitment to reward short- and long-term performance that aligns with, and drives, value for our owners. Total direct compensation is generally positioned within a competitive range of the market median, with differentiation based on tenure, skills, proficiency and performance to attract and retain key talent.

Associate Engagement

We regularly collect feedback to better understand and improve the associate experience and identify opportunities to continually strengthen our culture. We want to know what is working well, what we can do better and how well our associates understand our priorities and live by the Tenets of Our Success. In 2023, 84% of respondents who received our full associate survey participated. Our results equaled or exceeded our survey provider’s High Performance Benchmark in eight of thirteen categories and equaled or increased our favorable results in eleven of thirteen categories since our last full survey in 2021.

We help our associates and communities thrive through career development programs, embracing inclusivity and diversity while promoting service and our continued focus on health and safety. We are proud to support the philanthropic interests of our associates through volunteerism and giving programs.

9

Training and Development

People development is foundational to our success. We continually invest in our associates’ career growth and provide a wide range of development opportunities. In 2024, approximately 77% of our executive positions were filled with internal candidates. We also deployed a new career development framework to further accelerate the development of our colleagues at all levels and areas of the business.

Health, Safety and Wellness

The physical health, financial well-being, life balance and mental health of our associates is vital to our success. Throughout the year, we encourage healthy behaviors through regular communications, educational sessions, voluntary progress tracking, wellness challenges and other incentives. In January 2021, we implemented a global employee assistance program to ensure that all associates and their immediate families have access to many tools and sources of support that address their financial, physical and mental well-being. Our warehouse and integration facilities continue to represent our most significant health and safety risks. Our global health and safety leadership team uses our global injury and illness reporting system to assess trends regionally and worldwide as part of quarterly reviews. Managing and reducing risks at these facilities remains a focus, and injury rates continue to be low.

Sustainable Impact

Our sustainable impact program is overseen by an executive steering committee consisting of our:

•Chief Executive Officer,

•Executive Vice President and Chief Financial Officer,

•Executive Vice President, Secretary and General Counsel,

•Executive Vice President, Human Resources, and

•Executive Vice President, Global Operations and Engineering.

This executive steering committee receives periodic briefings from our global sustainability team and individual program owners. Responsibility is one of the Tenets of Our Success as a company, and environmental stewardship is one area in which we demonstrate our responsibility. We have established targets for reducing greenhouse gas (“GHG”) emissions and waste in our operations. In December 2024, Ingram Micro received approval from the Science Based Targets initiative for its near-term climate targets, including its goal to reduce absolute Scope 1 and 2 GHG emissions by 90% by 2030, using a 2022 base year.

To support a circular economy, our ITAD business focuses on the reuse and recycling of electronics, and, as of December 28, 2024, a total of five of our ITAD processing facilities held e-Stewards certifications, four of which were in North America. Since 2019, we have been a registered SmartWay Shipper Partner in the Environmental Protection Agency’s SmartWay Program, which allows us to benchmark our performance and assess the environmental impact of our transportation in the United States, as well as measure the fuel efficiency of our carrier partners, helping us address the carbon impacts of goods movement within our value chain.

In early 2024, the Company’s broad-based sustainability efforts were recognized by EcoVadis, a well-known third-party provider of evidence-based business sustainability assessments, who gave Ingram Micro a Platinum medal rating, reserved for the top one percent of the more than 125,000 companies on its platform. We believe this recognition signifies a substantial validation of our company’s commitment and leadership in sustainable and responsible business operations.

Available Information

Our website is http://www.ingrammicro.com. We make available free of charge, on or through our website, our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, if any, or other filings filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after electronically filing or furnishing these reports with the Securities and Exchange Commission ("SEC"). We also make available free of charge on our investor relations website at ir.ingrammicro.com our Audit Committee Charter, Compensation Committee Charter, Nominating and Corporate Governance Committee Charter, Code of Conduct, Corporate Governance Guidelines, Insider Trading Policy, Board Communications with Stockholders Policy, Anti-Bribery policy, and Non-Retaliation Policies.

10

The SEC maintains an Internet site at http://www.sec.gov that contains our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, if any, or other filings filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, and our proxy and information statements. Unless expressly noted, the information on our website, including our investor relations website, or any other website is not incorporated by reference in this Annual Report on Form 10-K and should not be considered part of this Annual Report on Form 10-K or any other filing we make with the SEC.

11

Item 1A. Risk Factors

An investment in our Common Stock involves a high degree of risk. A description of the risks and uncertainties associated with our business is set forth below. You should carefully consider the risks described below as well as the other information in this Annual Report on Form 10-K, including our consolidated financial statements and the notes thereto, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The occurrence of any of the events or developments described below could adversely affect our business, results of operations, financial condition, cash flows, reputation, or growth prospects, which could, in turn, adversely affect our stock price. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial could also present significant risks to our business. Investors should carefully consider all relevant risks before investing in our common stock.

Summary of Risk Factors

The following summary provides an overview of the material risks to which we are exposed, as set forth in greater detail further below. These risks include, but are not limited to, the following:

•our ability to predict our results of operations, which may fluctuate significantly;

•our ability to continue to successfully develop, deploy, and operationalize Ingram Micro Xvantage;

•industry and market conditions, inflation, volatility, and developments, including supply constraints across many elements of technology;

•the level of success of our acquisition and investment strategies;

•the effect of the COVID-19 pandemic or other public health issues on our business;

•our ability to pay cash dividends and our ability to generate the funds necessary to meet our outstanding debt services and other obligations as our sole material asset is our direct interest in Ingram Micro Inc.;

• our ability to retain and recruit key personnel;

•the high level of competition in our industry;

•the effect of various political, geopolitical, and economic issues, including tariffs, and our ability to comply with laws and regulations we are subject to, both in the United States and internationally;

•our ability to adjust to developments in the economic or regulatory environment;

•our financial leverage, which could adversely affect our ability to raise additional capital to fund our operations, and other risks related to indebtedness;

•our reliance on third-party service providers to facilitate the sale of our products and solutions;

•our ability to maintain existing vendors and customers and accurately forecast customer demand;

•our ability to maintain, upgrade, and protect our information systems, including Xvantage;

•Platinum’s significant influence over us and our status as a “controlled company” under the rules of the New York Stock Exchange (“NYSE”);

•our ability to prevent fraud and maintain an appropriate control environment;

•the adverse effects of the material weaknesses in our internal control over financial reporting on investor confidence and the price of our Common Stock, or on our ability to comply with applicable laws and regulations; and

•the volatility of our stock price which may result in stockholders’ inability to sell shares at or above the price paid.

12

Risks Related to Our Business and Our Industry

Our quarterly results have fluctuated significantly.

Our quarterly operating results have fluctuated significantly in the past and will likely continue to do so in the future as a result of:

•general changes in economic or geopolitical conditions, including changes in legislation or regulatory environments in which we operate and changes in import and export regulations, tariffs, or taxes and duties;

•competitive conditions in our industry, which may impact the prices charged and terms and conditions imposed by our vendors and/or competitors and the prices we charge our customers, which in turn may negatively impact our revenues and/or gross margins;

•variations in purchase discounts and rebates from vendors based on various factors, including changes to sales or purchase volume, changes to objectives set by the vendors, and changes in timing of receipt of discounts and rebates;

•seasonal variations in the demand for our products and services, which historically have included lower demand in Europe during the summer months, worldwide pre-holiday stocking in the retail and e-tail channels during the September-to-December period, and the seasonal increase in demand for our fulfillment services in the fourth quarter, driven by end-of-year purchasing cycles, affecting our operating expenses and gross margins;

•changes in businesses’ and consumers’ purchasing behaviors, including the rates at which they replace or upgrade technology solutions, and the impacts that fluctuating demand across different product categories, which also carry varying profitability and working capital profiles, can have on our overall results;

•changes in product mix, including entry or expansion into new markets, new product offerings, and the exit or retraction of certain business;

•the impact of and possible disruption caused by integration and reorganization of our businesses and efforts to improve our IT capabilities, as well as the related expenses and/or charges;

•currency fluctuations in countries in which we operate;

•variations in our levels of excess inventory and doubtful accounts, and changes in the terms of vendor-sponsored programs such as price protection and return rights;

•changes in the level of our operating expenses;

•the impact of acquisitions and divestitures;

•variations in the mix of profits between multiple tax jurisdictions, including losses in certain tax jurisdictions in which we are not able to record a tax benefit, as well as changes in assessments of uncertain tax positions or changes in the valuation allowances on our deferred tax assets, which could affect our provision for taxes and effective tax rate;

•the occurrence of unexpected events or the resolution of existing uncertainties, including, but not limited to, litigation or regulatory matters;

•the loss or consolidation of one or more of our major vendors or customers;

•product supply constraints; and

•inflation, interest rate fluctuations and/or credit market volatility, which may increase our borrowing costs and may influence the willingness or ability of customers and end users to purchase products and services.

These historical variations in our business may not be indicative of future trends in the near term. We believe that investors should not rely on period-to-period comparisons of our operating results as an indication of future performance. In addition, the results of any quarterly period are not indicative of results to be expected for a full fiscal year.

13

We have invested, and will continue to invest, significant resources in the development and deployment of Ingram Micro Xvantage, and if Ingram Micro Xvantage is not successful, our business, results of operations, financial condition, and cash flows could be adversely impacted.

We have made, and expect to continue to make, substantial investments to develop a transformative digital platform to provide a singular experience for our associates, vendors, and customers to facilitate the consumption of technology and accelerate the benefits innovative technology brings to our customers. However, we may not be able to continue to successfully develop or effectively implement Ingram Micro Xvantage in a timely, cost-effective, compliant, secure, and responsible manner. Any difficulties in implementing or integrating Ingram Micro Xvantage, or failures in including appropriate cybersecurity and data privacy protections within the platform, could have an adverse effect on our business, results of operations, financial condition, and cash flows.

Further, if our competitors develop and introduce similar services in the future, our future success will depend, in part, on our ability to develop and provide competitive technologies, and we may not be able to do so timely, effectively or at all. As AI and other technologies improve in the future, we may be required to make significant capital expenditures to remain competitive, which may have an adverse effect on our results of operations, and our failure to do so in a timely, cost-effective, compliant, secure, and responsible manner may adversely impact our growth, revenue, and profit. There is also no guarantee that such investment in Ingram Micro Xvantage, AI, or future technologies will create additional efficiencies in our operations.

Our acquisition and investment strategies may not produce the expected benefits, which may adversely affect our results of operations.

We have made, and expect to continue to make, acquisitions or investments in companies around the world to further our strategic objectives and support key business initiatives. Significant risks and uncertainties related to our acquisition and investment strategies that may differ from those historically associated with our operations and that could materially and adversely affect our financial performance include the following:

•acquisitions that do not strategically align with our goals and growth initiatives;

•valuation methodologies that result in overpayment for an asset;

•failure to identify risks during due diligence processes or to accurately quantify the probability, severity and potential impact of the risks on our business;

•exposure to new regulations, such as those relating to U.S. federal government procurement regulations, those in new geographies or those applicable to new products or services;

•inability to successfully integrate the acquired businesses, which may be more difficult, costly or time-consuming than anticipated, including inability to retain key management associates and other personnel who could be critical to the acquisition strategy, current business operations and growth potential of the acquired operations; difficulties realizing revenue and cost savings synergies, which could hamper the growth and profitability of the core business operations and lead to distraction of management; difficulties with integrating different business systems and technology platforms and consolidating corporate, administrative, technological and operational infrastructures;

•distraction of management’s attention away from existing business operations while coordinating and integrating new and sometimes geographically dispersed organizations;

•insufficient profit generation to offset liabilities assumed and expenses associated with the investment strategy;

•inability to preserve our and the acquired company’s customer, supplier and other important relationships;

•inability to successfully protect and defend acquired intellectual property rights;

•inability to adapt to challenges of new markets, including geographies, products and services, or to identify new profitable business opportunities from expansion of existing products or services;

•inability to adequately bridge possible differences in cultures, business practices and management philosophies;

•inability to successfully operate in a new line of business;

•substantial increases in our debt; and

14

•issues not discovered in our due diligence process.

In addition, we may divest business units that do not meet our strategic, financial and/or risk tolerance objectives. No assurance can be given that we will be able to dispose of business units on favorable terms or without significant costs.

We have been, and may continue to be, affected by the COVID-19 pandemic or other public health issues, and such effects could have an adverse effect on our business operations, results of operations, cash flows and financial condition.

We experienced disruptions to our business from the COVID-19 pandemic, and the potential for future disruptions related to COVID-19 or other public health issues is unpredictable. Due to lockdowns, our operations in certain countries, including China, Peru, Malaysia, Lebanon, Germany, the United Kingdom, Colombia, India and Dubai, were closed for periods of time with limited or no ability to operate. Specifically, the lockdown in India halted our operations for approximately two months in 2020. In addition, our operations and business in China were negatively impacted by the widespread lockdowns in 2022. In part as a result of the COVID-19 pandemic, we also encountered industry-wide supply chain challenges, including shipping and logistics challenges and significant limits on component supplies, which have adversely impacted (primarily in 2021 and 2022), and may continue to impact, our ability to meet demand, resulting in additional costs or otherwise adversely impacting our business, financial condition and results of operations. Additionally, in many countries in which we operate, a number of our associates have been infected with COVID-19, which has, at times, limited our available workforce. In the United States, the cost of labor and attrition increased in 2021 and 2022, making the labor market increasingly competitive. While many of these impacts of the COVID-19 pandemic had eased considerably by 2023, in the future we may again experience restrictions on high-volume shipping, supply chain volatility and product constraints, an increasingly competitive temporary labor workforce market and negative impact on the health and safety of our workforce, which could materially and adversely affect our business, results of operations, financial condition and cash flows.

Our management has taken measures, when appropriate, both voluntarily and as a result of government directives and guidance, to mitigate the effects of the COVID-19 pandemic on us and others. These measures have included, among others, the ability of certain associates to work remotely, which has placed a burden on our IT systems, created declines in productivity, and exposed us to increased vulnerability to cyberattack and other cyber disruption, impacts which we may not be able to fully mitigate. Because certain of our associates transitioned to working remotely on a mandatory or voluntary basis for a prolonged period of time, our return-to-office plans have, in some cases, led to associate attrition. Pandemic-related and post-pandemic-related changes in workforce patterns have resulted, and may continue to result, in additional attrition, difficulty in hiring and reduced productivity. See “Failure to retain and recruit key personnel would harm our ability to meet key objectives.” Many of these measures resulted in, and may in the future result in, incremental costs to us, and such costs may not be recoverable or adequately covered by our insurance.

In addition, we cannot fully predict the impact that public health issues will have on our customers, associates, vendors, suppliers, end users, strategic partners and other business partners and each of their financial conditions; however, any material effect on these parties could materially and adversely impact us. The impact of public health issues may also include possible impairment or other charges and may exacerbate other risks described below, any of which could have a material effect on us.

15

We are a holding company with no direct operations. Our sole material asset is our indirect equity interest in Ingram Micro Inc. and, as such, we will depend on our subsidiaries for cash to fund all of our expenses.

We are a holding company with no direct operations, and have no material assets other than our indirect ownership of the stock of Ingram Micro Inc. and the direct and indirect ownership of its subsidiaries, which are the key operating subsidiaries. Our ability to pay cash dividends and our ability to generate the funds necessary to meet our outstanding debt service and other obligations will depend on the payment of distributions by our current and future subsidiaries, including, without limitation, Ingram Micro Inc., and such distributions may be restricted by law, taxes, or repatriation or the instruments governing our indebtedness, including the indenture that governs the 2029 Notes (as defined below), dated as of April 22, 2021, by and between Imola Merger Corporation and the Bank of New York Mellon Trust Company, N.A., as trustee and notes collateral agent, as supplemented by that certain supplemental indenture, by and among Ingram Micro Inc., as issuer, the Guarantors (as defined therein) party thereto from time to time, and the Bank of New York Mellon Trust Company, N.A., as trustee and notes collateral agent (the “Indenture”), the credit agreement that governs the ABL Revolving Credit Facility (as defined below) and the ABL Term Loan Facility (as defined below), dated as of July 2, 2021, by and among Imola Acquisition Corporation, Ingram Micro Inc., the borrowers therein, various lenders and issuing banks, and JP Morgan Chase Bank, N.A., as amended from time to time (the “ABL Credit Agreement”) and the term loan credit agreement that governs the Term Loan Credit Facility (as defined below), dated as of July 2, 2021, by and among Imola Acquisition Corporation, Ingram Micro Inc., JP Morgan Chase Bank, N.A., and the lenders, agents and other parties thereto, as amended from time to time, (the “Term Loan Credit Agreement”, and together with the ABL Credit Agreement, the “Credit Agreements”), or other agreements of our subsidiaries. Our subsidiaries may not generate sufficient cash from operations to enable us to make principal and interest payments on our indebtedness.

Failure to retain and recruit key personnel would harm our ability to meet key objectives.

Because of the complex and diverse nature of our business, which includes a high volume of transactions, business complexity, wide geographical coverage and a broad scope of products, vendors, suppliers and customers, we are highly dependent on our ability to retain the services of our key management, sales, IT, operations and finance personnel. Our continued success is also dependent upon our ability to retain and recruit other qualified associates, including highly skilled technical, managerial and marketing personnel and to provide growth and development opportunities and reward incentives that drive above-market performance. Competition for qualified personnel is intense and the costs of qualified talent are increasing. We may not be successful in attracting and retaining the personnel we require, which could have a material adverse effect on our business. In addition, our entry into new markets requires us to hire qualified personnel with new capabilities, and our increasing global footprint requires us to recruit talent in new geographies. We constantly review market conditions and other factors; however, we may fail to make staffing adjustments based on current and forecasted conditions. While these adjustments are generally small, there are occasions where we have reduced headcount in various geographies and functions through restructuring and outsourcing activities. The restructuring plans we have implemented, and any similar actions taken in the future, could negatively impact our relationships with vendors and customers, the morale of our workforce and our ability to attract, retain and motivate associates. In addition, failure to meet our performance targets may result in reduced levels of incentive compensation, which could affect our ability to adequately reward key personnel and potentially negatively impact retention. Changes in our workforce, including those resulting from acquisitions, and our failure to leverage shared services, could disrupt our operations or increase our operating cost structure. Government regulations, collective bargaining agreements and the unavailability of qualified personnel could also negatively impact operations and our costs.

In addition, we believe that our corporate culture is a critical component of our success. Remote work resulting from the COVID-19 pandemic has required us to make substantial changes to the way that many of our associates work. Remote work and geographically dispersed teams could negatively impact associate morale, the cohesiveness of and collaboration among our teams, as well as our ability to continue to innovate and maintain our culture. Any failure to preserve our culture and maintain associate morale could negatively affect our ability to retain and recruit personnel. Further, as we have required associates to return to our office sites at least three days per week, we may not be able to retain associates or attract new associates who prefer to work from home on a full-time basis. The failure to attract and retain such personnel could adversely affect our business. Finally, as we continue to evolve various work-from-home policies and other hybrid workforce arrangements, we may not be able to adopt or implement such policies in a timely manner or efficiently adapt to requisite changes once such policies are in place.

16

Increases in wage and benefit costs, collective bargaining agreements, changes in laws and other labor regulations, or labor disruptions could impact our financial condition and cash flows.

Our expenses relating to employee labor, including employee health benefits, are significant. Our ability to control our employee and related labor costs is generally subject to numerous external factors, including prevailing wage rates, availability of labor, recent legislative and private sector initiatives regarding healthcare reform, and adoption of new or revised employment and labor laws and regulations; for example, recently, various legislative movements have sought to increase the federal minimum wage in the United States and the minimum wage in a number of individual states, some of which have been successful at the state level. Several employers in the private sector with whom we compete for permanent and seasonal labor have initiated wage increases and provided special benefits and incentives that may go beyond the minimum required by law. As minimum and market wage rates increase, we may need to increase not only the wage rates of our minimum wage associates, but also the wages paid to our other associates as well. A number of factors may adversely affect the labor force available to us, including high employment levels, federal and state unemployment subsidies, and other government regulations. In certain markets, such as the United States and Europe, labor shortages remain a challenge. Such shortages have led, and are likely to continue to lead, to higher wages for associates in order for us to provide competitive compensation. Should we fail to increase our wages competitively in response to increasing wage rates or labor shortages, the quality of our workforce could decline, adversely affecting our customer service and our overall business operations. Additionally, any increase in the cost of our labor could have an adverse and material effect on our operating costs, financial condition, and results of operations.

In addition, while we do not have unions in the United States, some of our associates are covered by collective bargaining agreements and works council arrangements in a number of the countries in which we operate including Australia, Brazil, Chile, Costa Rica, France, Germany, Mexico, the Netherlands, Poland, Spain, Sweden and the United Kingdom. Future negotiations prior to the expiration of our collective agreements may result in labor unrest for which a strike or work stoppage is possible. Strikes and/or work stoppages could negatively affect our operational and financial results and may increase operating expenses. In addition, any future unionization efforts would require us to incur additional costs related to wages and benefits, inefficiencies in operations, unanticipated costs in sourcing temporary or third-party labor, legal fees and interference with customer relationships. If a significant number of our associates were to become unionized and collective bargaining agreement terms were significantly different from our current arrangements, we may experience a material adverse effect on our business, results of operations, financial condition and cash flows. In addition, a labor dispute involving some of our associates may harm our reputation, disrupt our operations and reduce our revenue, and resolution of disputes may increase our costs.

We are also required to comply with laws and regulations in the countries in which we have associates that may differ substantially from country to country, requiring significant management attention and cost.

While we have not experienced any material work stoppages at any of our facilities, any stoppage or slowdown could cause material interruptions in our business, and we cannot assure investors that alternate qualified personnel would be available on a timely basis, or at all.

Our failure to adequately adapt to industry changes could negatively impact our future operating results.

The technology and IT services industry is subject to rapid and disruptive technological change, new and enhanced product specification requirements, evolving industry standards, and changes in the way technology products are distributed, managed or consumed. We have been, and will continue to be, dependent on innovations in hardware, software, and services offerings, as well as the acceptance of those innovations by customers and consumers. Our failure to add new products and vendors, a decrease in the rate of innovation, or the lack of acceptance of innovations by customers, could have a material adverse effect on our business, results of operations, financial condition, and cash flows. Vendors may also give us limited or no access to new products being introduced.

Changes in technology may cause the value of our inventory on hand to substantially decline or become obsolete, regardless of the general economic environment. Although it is the policy of many of our vendors to offer limited protection from the loss in value of inventory due to technological change or due to the vendors’ price reductions (“price protections”), such policies are often subject to time restrictions and do not protect us in all cases of declines in inventory value. If our major vendors decrease or eliminate our price protection, such a change in policy could lower our gross margins on products we sell or cause us to record inventory write-downs. In addition, vendors could become insolvent and unable to fulfill their protection obligations to us. We offer no assurance that inventory rotation or price protection rights will continue, that unforeseen new product developments will not adversely affect us, or that we will successfully manage our existing and future inventories.

17

Significant changes in vendor terms, such as higher thresholds on sales volume before the application of discounts and/or rebates, the overall reduction in incentives, reduction or termination of price protection, return levels or other inventory management programs, or reductions in trade credit or vendor-supported credit programs, may adversely impact our results of operations or financial condition.

The advent of cloud-based and consumption-based services creates business opportunities and risks, including that our customer base may lack the expertise and capital required to support and enable the migration to the cloud and, as a result, end users may seek to source their solutions directly from software developers. Further, our experience platform requires significant engineering expertise and investments to be able to evolve along with the offerings of our software partners. We may not invest enough or be able to attract talent to advance our proprietary technology.

Further, some of our established vendors are transitioning to as-a-service companies, providing their entire portfolio through a range of subscription-based, pay-per-use and as-a-service offerings. Many of our vendors also continue to provide hardware and software in a capital expenditure and license-based model, ultimately giving end users a choice in consuming products and services in a traditional or as-a-service offering. While we are seeking to participate in both the on-premises and cloud-based markets, such business model changes entail significant risks and uncertainties, and our vendors, resellers and we may be unable to complete the transition to a subscription-based business model or manage the transition successfully. Additionally, we may not realize all of the anticipated benefits of the transition to the new consumption model, even if it is successfully completed. The transition also means that our historical results, especially those achieved before the transition, may not be indicative of our future results. Further, as customer demand for our consumption model offerings increases, we may experience differences in the timing of revenue recognition between our traditional offerings (for which revenue is generally recognized at the time of delivery) and our as-a-service offerings (for which revenue is generally recognized ratably over the term of the arrangement), which could have an adverse effect on our business, results of operations, financial condition, and cash flows.

We continually experience intense competition across all markets for our products and services.

Our competitors include local, regional, national, and international distributors, service providers and e-retailers, as well as suppliers that employ a direct-sales model. As a result of intense price competition in the technology and IT services industries, our gross margins have historically been narrow, and we expect them to continue to be narrow in the future, which magnifies the impact of variations in revenue, operating costs, obsolescence, foreign exchange, and bad debt on our operating results. In addition, when there is overcapacity in our industry, our competitors may respond by reducing their prices, and our vendors may reduce the number of authorized distributors, potentially limiting our ability to distribute certain products and services.

The competitive landscape has also experienced a consolidation among vendors, suppliers, and customers and this trend is expected to continue, which could result in a reduction or elimination of promotional activities by the remaining vendors, suppliers, and customers as they seek to reduce their expenses, which could, in turn, result in decreased demand from end users and our reseller customers for our products or services. Additionally, the trend toward consolidation within the mobile operator community is expected to continue, which could result in a reduction or elimination of promotional activities by the remaining mobile operators as they seek to reduce their expenses, which could, in turn, result in decreased demand for our products or services. Moreover, consolidation of mobile operators reduces the number of potential contracts available to us and other providers of logistics services. We could also lose business if mobile operators that are our customers are acquired by other mobile operators that are customers of our competitors, or we could face price pressures if our mobile operator customers are acquired by other mobile operators that are our customers.

We offer no assurance that we will not lose market share, or that we will not be forced in the future to reduce our prices in response to the actions of our competitors, which may put pressure on our gross margins. Furthermore, to remain competitive we may be forced to offer more credit or extended payment terms to our customers. This could increase our required capital, financing costs, and the amount of our bad debt expenses. Customers, suppliers, and lenders may also seek commitments from us related to sustainability and environmental impacts, and meeting these commitments may increase our cost of operations or preclude some customers from doing business with us if we cannot meet their standards.

We have also initiated, and expect to continue to initiate, other business activities and may face competition from companies with more experience and/or from new entrants in those markets. As we enter new areas of business or geographies or as we expand our offerings of new products or vendors, we may encounter increased competition from current competitors and/or from new competitors, some of which may be our current customers or suppliers, which may negatively impact our sales or profitability.

18

We have operations in countries spanning all global regions, and we sell our products and services to a global customer base. We are subject to anti-competition regulations in the markets we serve, and our market share may adversely impact our ability to further expand our business, as well as increase the number of compliance requirements to which we are subject and the costs associated with such compliance.

The merger of two of our competitors, Synnex and Tech Data Corporation, in September 2021 to become TD Synnex, the industry’s largest IT distributor in the United States, as well as further consolidation in our industry may be disruptive to our business in a number of ways, including, but not limited to, by affecting the availability and pricing of credit lines extended by our vendors and other capital suppliers to us, any reduction of price protection, stock rotation, or similar vendor incentives, heightening pricing pressures and competition for customers and impacting our attractiveness to top talent.

Our goodwill and identifiable intangible assets could become impaired, which could reduce the value of our assets and reduce our net income in the year in which the write-off occurs.

Goodwill represents the excess of the cost of an acquisition over the fair value of the assets acquired. We also ascribe value to certain identifiable intangible assets, which consist primarily of intellectual property, customer relationships, and trade names, among others, as a result of acquisitions. We may incur impairment charges on goodwill or identifiable intangible assets if we determine that the fair values of the goodwill or identifiable intangible assets are less than their current carrying values. We evaluate, at least annually, whether events or circumstances have occurred that indicate all, or a portion, of the fair value of a reporting unit is less than its carrying amount, in which case an impairment charge to earnings would become necessary.

A decline in general economic conditions or global equity valuations could impact our judgments and assumptions about the fair value of our businesses and we could be required to record impairment charges on our goodwill or other identifiable intangible assets in the future.

We have incurred and will incur additional amortization expense over the useful lives of certain assets acquired in connection with business combinations, and to the extent that the value of goodwill or intangible assets with indefinite lives acquired in connection with a business combination and investment transaction become impaired, we may be required to incur material charges relating to the impairment of those assets. If our future results of operations for these acquired businesses do not perform as expected or are negatively impacted by any of the risk factors noted herein or other unforeseen events, we may have to recognize impairment charges which would adversely affect our results of operations.

Changes in our credit rating or other market factors, such as adverse capital and credit market conditions or reductions in cash flow from operations, may affect our ability to meet liquidity needs, reduce access to capital, and/or increase our costs of borrowing.

Our business requires significant levels of capital to finance accounts receivable and product inventory that is not financed by our trade credit with our vendors. This is especially true when our business is expanding, including through acquisitions, but we may still have substantial demand for capital even during periods of stagnant or declining net sales. In order to continue operating our business, we will continue to need access to capital, including debt financing and inbound and outbound flooring. In addition, changes in payment terms with either suppliers or customers could increase our capital requirements. Our ability to repay current or future indebtedness when due, or have adequate sources of liquidity to meet our business needs, may be affected by changes to the cash flows of our subsidiaries. A reduction of cash flow generated by our subsidiaries may have an adverse effect on our liquidity. Under certain circumstances, legal, tax, or contractual restrictions may limit our ability or make it more costly to redistribute cash between subsidiaries to meet our overall operational or strategic investment needs, or for repayment of indebtedness requirements.

19

We believe that our existing sources of liquidity, including cash resources and cash provided by operating activities, supplemented as necessary with funds available under our credit arrangements, will provide sufficient resources to meet our working capital and cash requirements for at least the next 12 months. However, volatility and disruption in the capital and credit markets, including increasingly complex regulatory constraints on these markets and changes in existing and expected interest rates, may increase our costs for accessing the capital and credit markets. In addition, our credit ratings reflect each rating organization’s opinion of our financial strength, operating performance, and ability to meet our debt obligations, and there can be no assurance that we will achieve a particular rating or maintain a particular rating in the future. An inability to obtain or maintain a particular rating could increase the cost and impact the availability of future borrowings. These and other adverse capital and credit market conditions, including the inability of our finance partners to meet their commitments to us, may also limit our ability to replace maturing credit arrangements in a timely manner and affect our ability to access committed capacities or the capital we require on terms acceptable to us, or at all. See “—Risks Related to Our Indebtedness—Our substantial indebtedness could materially and adversely affect our financial condition, limit our ability to raise additional capital to fund our operations, limit our ability to increase or maintain existing levels of trade credit supplied from our suppliers, and prevent us from fulfilling our obligations under our indebtedness.” Furthermore, any failure to comply with the various covenant requirements of our corporate finance programs, including cross-default threshold provisions, could result in an event of default, which, if not cured or waived, could accelerate our repayment obligations and could affect our ability to access the majority of our credit programs with our finance partners. The acceleration of our repayment obligations or the lack of availability of such funding could materially harm our ability to operate or expand our business.

In addition, our cash and cash equivalents (including trade receivables collected and/or monies set aside for payment to creditors) are deposited and/or invested with various financial institutions located in the various countries in which we operate. We endeavor to monitor these financial institutions regularly for credit quality; however, we are exposed to risk of loss on such funds or we may experience significant disruptions in our liquidity needs if one or more of these financial institutions were to suffer bankruptcy or similar restructuring.

We cannot predict the outcome of litigation matters and other contingencies with which we may be involved from time to time.

We are involved, and in the future may become involved, in various claims, disputes, lawsuits, and actions. Other than as discussed in Note 9, “Commitments and Contingencies,” to our audited consolidated financial statements, we do not believe that the ultimate resolution of matters currently pending will have a material adverse effect on our business, results of operations, financial condition, and cash flows. We can make no assurances that we will ultimately be successful in our defense or prosecution of any of these matters or of any future matters. In addition, from time to time, we are, and may become, the subject of inquiries, requests for information, or investigations by government and regulatory agencies regarding our business. Any such matters, regardless of their merit or resolution, could be costly and divert the efforts and attention of our management and other associates, damage our reputation, or otherwise adversely affect our business. For more information regarding our current litigation matters, see Note 9, “Commitments and Contingencies,” to our audited consolidated financial statements.

Risks Related to the Macroeconomic and Regulatory Environment

We operate a global business that exposes us to risks associated with conducting business in multiple jurisdictions.